Concerns from Washington — President Trump’s bold claims of ushering in an economic “golden age” seem to clash with reality, highlighted by a series of weak economic indicators surfacing this week. The effects of his policies are starting to take shape, and they don’t paint a rosy picture.

Job Market Woes — Employment gains are decreasing, inflation is starting to creep up, and economic growth has noticeably slowed when compared to the previous year.

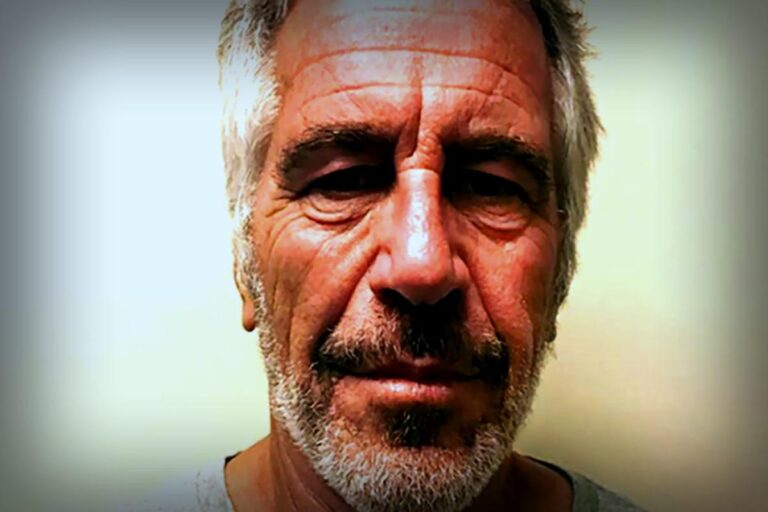

As Trump approaches the halfway mark of his term, his aggressive strategies like tariff hikes and a pivotal new tax and spending legislation have significantly altered the landscape of U.S. trade, manufacturing, and energy domains. While he remains eager to take credit for positive shifts, he is also looking for scapegoats should the economy start showing cracks.

This is far from the booming economy Trump repeatedly promised. Moreover, his justification for blaming his Democratic predecessor, Joe Biden, for any dismal economic signs washes away as the global economy closely watches his every move and tweet.

When the gloomy jobs report came out on Friday, Trump dismissed the alarming data and sacked the director of the agency responsible for releasing these monthly hooks.

Amid this, he conveyed on Truth Social, “Important numbers like this must be fair and accurate; they can’t be manipulated for political purposes,” providing no supportive evidence for his assertion. He also maintained that, “The Economy is BOOMING.”

Yet, it’s possible that these disheartening numbers are merely bumps in the road from the sweeping changes he’s enacted — an indicator that, perhaps, more turbulence lies ahead.

Political Risks of Trump’s Economic Moves

Trump’s implements of tariffs and changes in taxation present significant political risks if prosperity for the middle class fails to materialize. The ramifications of these tariff increases won’t surface fully for several months, coinciding dangerously with the lead-up to midterm elections for his Congressional allies.

According to Alex Conant, a Republican strategist at Firehouse Strategies, “Given that his term is still relatively new, Trump has already dramatically influenced the economy. The inflationary effects of the tariffs won’t be felt until 2026 — which is also an election year, a tough spot for Republicans.”

The White House had positioned the flurry of trade arrangements preceding Thursday’s tariff enforcement as a demonstration of Trump’s negotiating skills. Nations like the EU, Japan, South Korea, and Indonesia agreed to conditions that would raise tariffs on their goods without reciprocating with American exports, marking a complex game in trade dynamics.

As for the implications of these tariffs, many Americans will eventually bear the brunt in the form of increased prices, yet the extent remains hazy.

Kevin Madden, another Republican strategist, remarked that managing expectations surrounding Trump’s economy critically underlines the importance of maintaining favorable public perceptions.

Current statistics show only 38% of adults support Trump’s economic policy decisions, as per a July poll by The Associated Press. This figure dropped significantly since the end of his first term when half expressed approval of his economic management.

Despite this, the White House continues to project an optimistic view, suggesting that the economy is over its rocky phase following Trump’s broad restructuring efforts and aiming to revive those early accomplishments seen pre-pandemic onset.

“Trump is pushing forward with the same combination of deregulation alongside fair trade and tax cuts at a grander scale — as these strategies unfold, the best is yet to come,” remarked Kush Desai, the White House spokesman.

Economic Indicators Signal Challenges Ahead

Recent statistics illustrate the scope of the challenges Trump will face if this trajectory continues:

- Job Losses: The recent jobs report highlighted that the U.S. has lost 37,000 manufacturing jobs since Trump’s tariffs began in April, contrasting with optimistic claims of a revival.

- Hiring Slowdown: Over the last three months, net hiring plummeted, with meager job additions—73,000 in July, merely 14,000 in June, and 19,000 in May—a collective reduction of 258,000 jobs.

- Rising Prices: Inflation data from Thursday shows that prices have increased by 2.6% for the year ending in June, up from 2.2% in April. Notably, costs for imported goods, including appliances and furniture, surged from May to June.

- Stagnant Growth: A Wednesday report indicated that the gross domestic product (GDP) expanded at a disappointingly low rate of approximately 1.3% in the first half of the year, compared to 2.8% growth in the prior year.

“The economy is barely crawling forward,” noted Guy Berger, a senior fellow at the Burning Glass Institute focused on employment trends. “Sure, unemployment is steady, yet job creation is at a snail’s pace; overall, the economy’s growth feels lackluster.”

Arguments on Monetary Policy Create Controversy

Trump has sought to unload the blame onto Federal Reserve chairman Jerome Powell, pushing for cuts in benchmark interest rates — a move that could ironically elevate inflation instead of curbing it.

The president publicly supported two Fed governors, Christopher Waller and Michelle Bowman, after their votes for rate cuts, although their reasoning highlights concerns regarding an ailing job situation—an angle not favoring Trump’s narrative.

Such an ongoing overhaul of tariff policies — marked by shifts since April that previously set the stock market into a tumble — suggests it’s not merely a simple adjustment as communicated by some Fed members and Trump’s staff.

Warnings Ignored on Potential Downside of Tariffs

While Trump might brush off the uproar in response to his economic laws, it’s worth noting that warnings were given about potential fallout from these policies.

Biden voiced concerns even before exiting office during a speech last December at the Brookings Institution, indicating that tariffs could ultimately sting American workers and businesses.

“He seems insistent on imposing hefty, universal tariffs across the board on imported goods, convinced that foreign countries will absorb those costs rather than American consumers,” Biden commented. “I genuinely think this strategy is a major faux pas.”