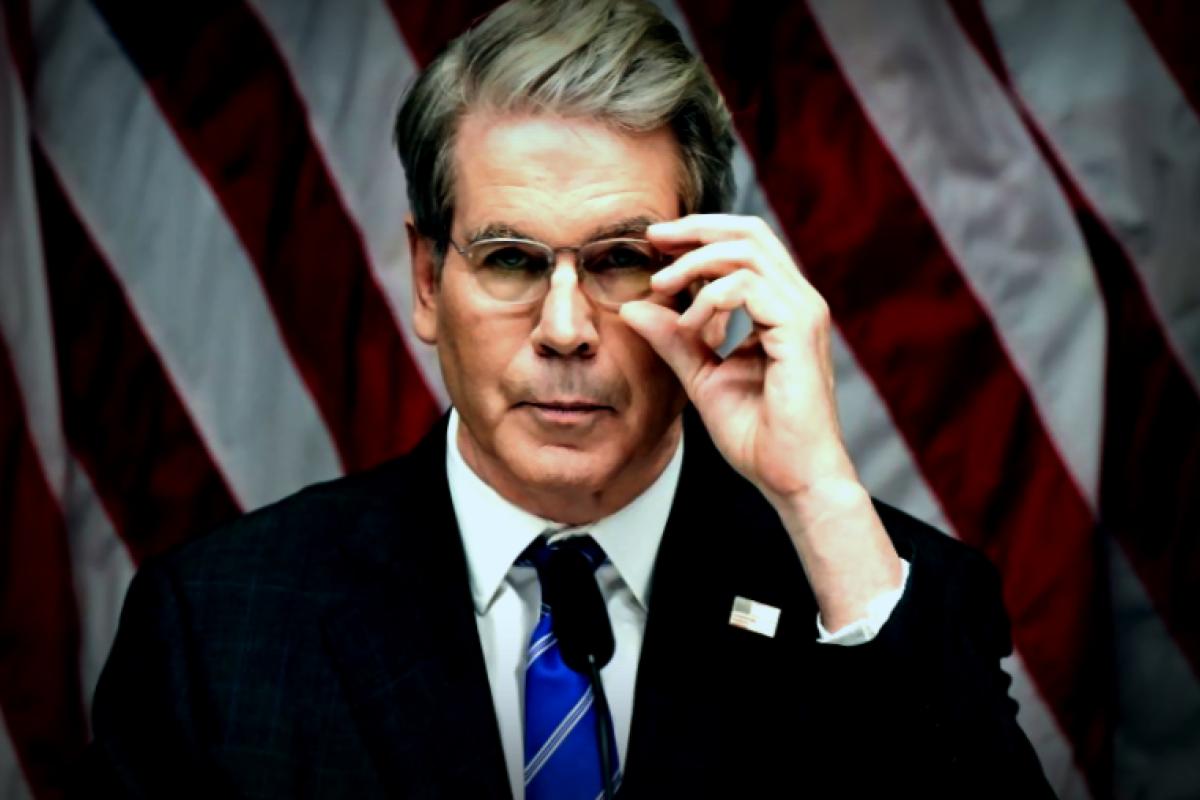

Treasury Secretary Scott Bessent took a firm stance this Tuesday against the idea that Americans might soon see tariff rebate checks coming their way.

In a recent chat on CNBC’s “Squawk Box”, Bessent explained that the revenue generated from import tariffs will primarily go toward addressing the US national debt.

“We’re focused on that goal,” Bessent mentioned, highlighting S&P Global’s recent affirmation of the United States’ AA+ credit rating. He added, “President [Donald] Trump and I are fully committed to reducing the debt.”

Interestingly, some lawmakers think that tariff revenue could send rebate checks of around $600 to each adult and dependent child. This means a family of four could potentially receive a total of about $2,400 from the government!

Since the implementation of Trump’s tariffs in April, the United States has raked in around $100 billion in tariff revenue, based on data from the Treasury Department up to July. Trump has touted this revenue’s potential for steering towards national debt alleviation while suggesting it could also serve as a “dividend” for the American populace.

Bessent noted that the actual tariff revenue is shaping up to surpass expectations. “I’ve been predicting it could hit $300 billion this year,” he stated. “I might need to revise that figure upwards significantly. It appears we’re on course to cut the deficit relative to our GDP, pay off debt, and who knows, down the line that money might benefit the American public.”

While Bessent withheld specifics on how much more he anticipates these revenues could grow, he suggested the increase would be substantial.

He also hinted at potential financial relief for Americans through lower interest rates.

Since last December, the Federal Reserve has maintained interest rates. As the chance of a rate cut in September increased after July’s relatively stagnant job report showed minimal employment uptick over the past three months, those favorable odds fell from nearly 100% to around 80% following recent inflation data, which indicated a slight surge in price hikes for consumers and businesses alike.

Bessent dismissed this inflation rise, attributing much of it to stock market gains.

“The core issue here is the distribution effects higher rates are having, particularly on lower-income families burdened by credit card debt and the housing market,” he expressed. “While capital expenditures are booming, driven partly by AI and changes in tax regulations, the housing sector is struggling.”

Bessent suggested that lowering interest rates could bolster home construction, which might help mitigate long-term price increases.

“What happens if we keep limiting home construction? What kind of inflation effects will we see in a year or two?” he pondered.

According to July data from the US Census Bureau, new home construction displayed a surprising surge, climbing 5.2% from June at an adjusted annual rate of 1.428 million homes—outsourcing economists’ forecasts of a more modest 0.3% increase at a rate of 1.31 million after a lackluster three months previously.

For ongoing updates on the news from CNN, consider creating an account at CNN.com