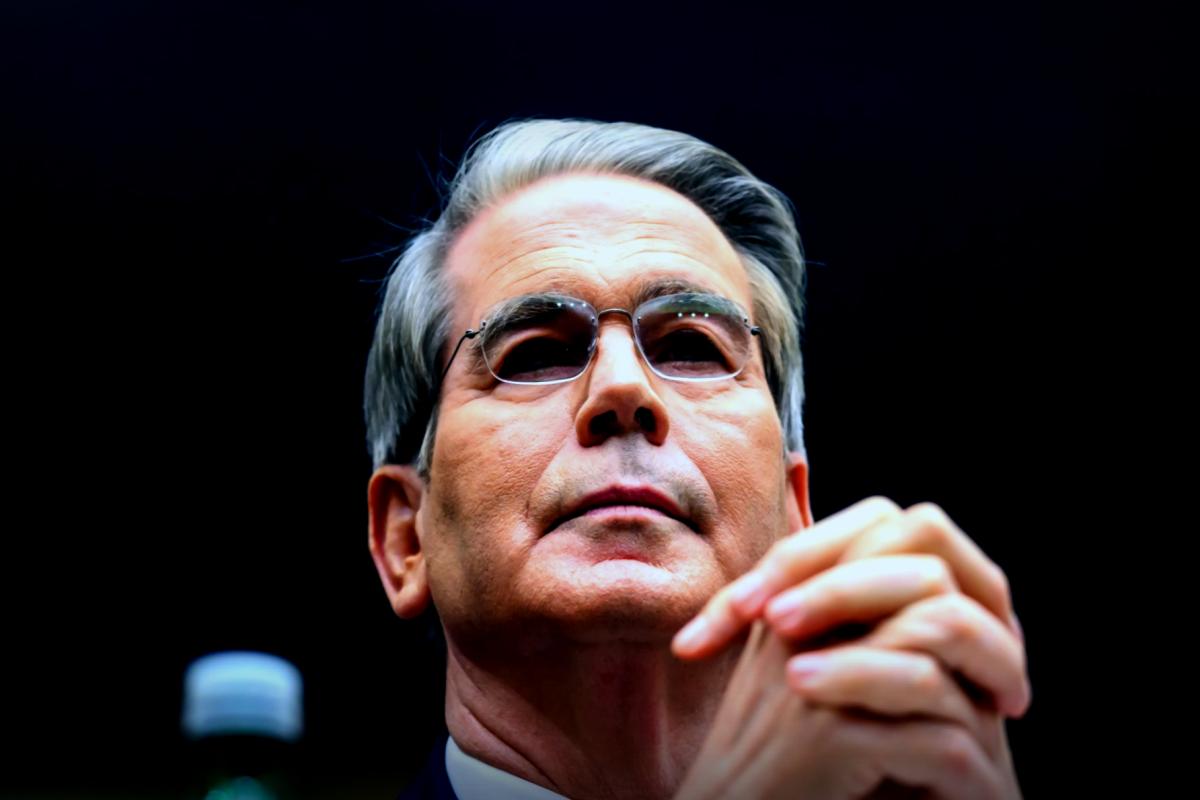

- Goldman Sachs and U.S. Treasury Secretary Scott Bessent are anticipating a significant surge in stablecoins, fueled by new regulations and enormous growth prospects for payments. These digital currencies, which need to be pegged to U.S. dollars or Treasuries, could create more interest in government bonds. However, some analysts contend this primarily just shifts existing money around, not necessarily increasing the overall desire for debt.

According to Financial Times, Bessent believes that stablecoins will give a robust boost to the U.S. Treasury market, prompting the government to increase short-term debt to respond to this heightened demand. He conveyed to Wall Street that he sees stablecoins—digital assets tied to reputable securities like Treasuries—as a crucial factor pushing up demand for U.S. government bonds.

Bessent indicated in a press release back in July that he foresees a strong appetite for cryptocurrencies that are fully backed by U.S. dollar equivalents supporting bond prices:

“This innovative tech will not only reinforce the dollar’s status as the leading global reserve currency but will also broaden access to the dollar economy for billions worldwide, resulting in increased demand for U.S. Treasuries underpinning stablecoins. The introduction of the GENIUS Act lays out clear regulations, paving the way for what could develop into a multitrillion-dollar industry in stablecoins,” he stated.

The GENIUS Act, introduced recently, aims to “align state and federal regulations concerning stablecoins to ensure non-partisan, stable oversight across the nation,” as noted by the White House in a recent statement.

So, how impactful are these developments likely to be?

Goldman Sachs suggested that we are on the cusp of a stablecoin rush, detailed in a research piece released today by their analyst Will Nance and team.

According to their findings, “The stablecoin market is currently valued at $271 billion, and we believe USDC [issued by Circle] is poised to acquire more market share, particularly on and off Binance’s platform. With stablecoin regulations legitimizing the market and the crypto landscape shifting, we project a growth of $77 billion for USDC, approximate to a 40% compound annual growth rate between 2024 and 2027. “

Goldman Sachs also outlined that the stablecoin opportunity could eventually reach several trillion dollars. They noted, “Visa estimates the addressable payments market to be about ~$240 trillion in annual payment volume. This includes consumer payments approximating ~$40 trillion of yearly spending, B2B payments around ~$60 billion, with the remainder comprising P2P payments and other disbursements. As a result, payments represent the most evident area for total addressable market expansion for stablecoins over the longer term, which is mostly underutilized right now—with the majority of stablecoin transactions being linked to cryptocurrency trading activity coupled with the search for dollar exposure beyond U.S. borders.”

Because stablecoins in the U.S. have to be backed 1:1 with either dollars or U.S. bonds, each stablecoin produced results in a greater need for those bonds. Many believe this could shake things up in the bond market, especially for short-duration bonds with typically low returns.

A research publication by the Bank for International Settlements suggests it will have repercussions. The paper notes: “A 2-standard deviation uptick in stablecoin demand could lower 3-month Treasury yields by roughly 2-2.5 basis points within ten days.” Different circumstances translate into different impacts in this sector: “The outflow of stablecoins can have a rate-increasing impact two to three times greater than the effects seen when demand flows in,” the study noted.

However, UBS’s Paul Donovan approaches this future with some skepticism, emphasizing, “While Secretary Bessent seems optimistic that stablecoins could drive interest in short-term U.S. Treasuries—helping finance the burgeoning U.S. deficit—stablecoins mostly redistribute the funds available. So when someone sells Treasury bills to buy stablecoins, which only invest back in Treasury bills, it doesn’t necessarily change the demand for U.S. debt instruments,” he advised his clients this morning.

Here’s a brief look at the markets before they opened in New York:

- S&P 500 futures did not show significant movement this morning after a drop of 0.59% the previous day.

- STOXX Europe 600 rose by 0.13% in early trades.

- The FTSE 100 in the U.K. increased by 0.23% at the start of the session.

- Japan’s Nikkei 225 declined by 1.51%.

- China’s CSI 300 went up by 1.14%.

- South Korea’s KOSPI fell by 0.68%.

- India’s Nifty 50 rose by 0.28% at the session’s end.

- Bitcoin slipped down to $113.9K.

This article originally appeared on Fortune.com.