Investing in robotics isn’t a new trend; it’s been on the radar for investors for decades. Yet, the introduction of artificial intelligence has revolutionized the field, taking it beyond basic automation and enhancing precision, flexibility, and adaptability.

Many savvy investors are funneling their money into AI infrastructures offered by tech giants, like Microsoft and Meta Platforms, or semiconductor stocks, especially NVIDIA. However, the world of robotics stocks might offer a unique opportunity for those looking to tap into the promising next wave of AI technology. These companies come with impressive markets ripe for growth.

Even though the prices of some robotics stocks appear to be “cheaper” when compared to specific AI stocks, they each carry their own unique risks that investors must assess. Nevertheless, these stocks are worth your attention, especially as we highlight three particularly noteworthy companies that are paving the way for future growth.

Focused Exposure with Solid Revenue Streams

When it comes to surgical applications of robotics, Intuitive Surgical Inc. (NASDAQ: ISRG) stands out as an innovator. Its flagship product, the da Vinci surgical system, holds a significant lead, boasting over 11,000 installations worldwide.

On top of that, Intuitive Surgical benefits from a robust services division that now contributes more than 80% to their overall annual revenue, giving the company a sustainable revenue model beyond just the initial sales of the system. The incorporation of AI has further improved the da Vinci system, equipping surgeons with better visualization tools, enhanced precision, and valuable training aids that collectively boost recovery times and outcomes.

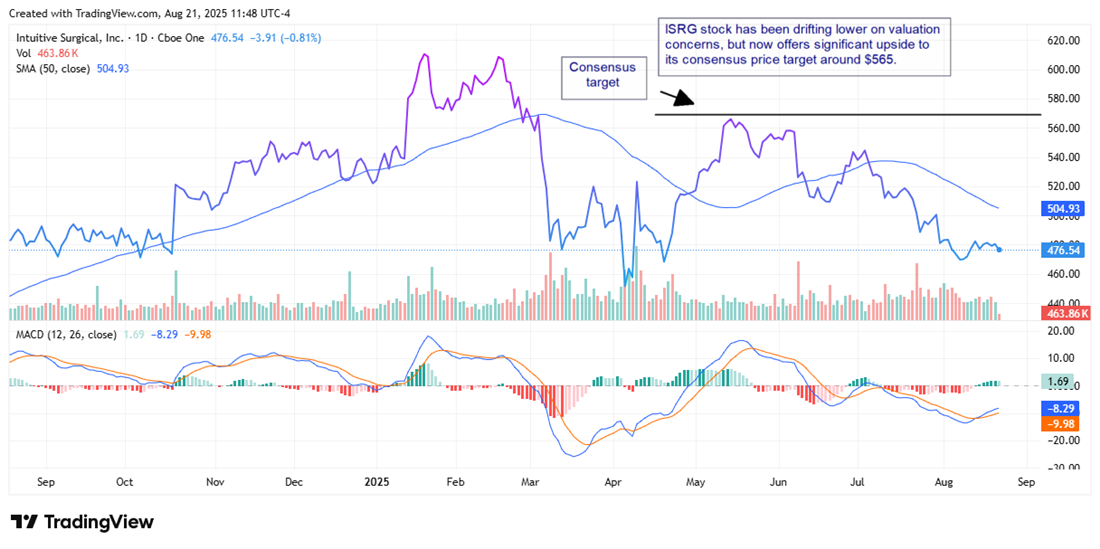

Intuitive Surgical recently made headlines with a strong earnings report, yet you wouldn’t guess that from the ISRG stock price, which has dipped by 8.6% in 2025 and about 7% post-report. Many point to the stock’s valuation at 74 times forward earnings as a key reason for this decline, speculating whether it should be classified alongside tech stocks—as its current valuation suggests—or med tech stocks.

Still, analysts believe there’s an upside ahead, with a consensus price target of $565.95, which opens up possibilities for more than a 25% gain from the current price.

Transforming Warehousing with Robotics

Symbotic Inc. (NASDAQ: SYM) represents the hardware angle of this evolving ecosystem. The company is reimagining warehouses by deploying autonomous systems that enhance logistics functions through AI.

With major backing from its partner and customer Walmart, Symbotic possesses the means to expand its services across various sectors within retail and logistics.

The impressive fleet of robots employed by Symbotic can swiftly store, locate, and arrange goods—offering a speed and accuracy far superior to human capabilities. Given the workforce challenges in today’s supply chain, this trait is incredibly valuable.

As its technology sees wider adoption, the company could generate substantial sustained revenue, mirroring a model similar to those in the software-as-a-service space.

Revolutionizing Office Tasks Through AI

When it comes to the blend of software and robotics, UiPath Inc. (NYSE: PATH) is a leading name. Specializing in robotic process automation (RPA), UiPath takes things a step further by simplifying mundane digital tasks, from invoices to compliance paperwork.

The addition of generative AI into its workflow platform streamlines operations efficiently, meaning that their software can steadily adapt. This type of groundbreaking AI can lead to elements of self-directed processes over traditional rigid setups.

UiPath boasts impressive customer retention, evidenced by a dollar-based net retention rate (DBNRR) of 108%. Still, growth might face some stress in the wake of rising interest rates; budgets tightening could impact new customer acquisitions more than actual funding.

That particular risk comes amidst an increasingly crowded space. Yet signs indicate potential for long-overlooked conditions suggesting a rebound for PATH stock.