Google ($GOOGL) has faced the tricky challenge of how to profit from artificial intelligence (AI) without jeopardizing its primary search engine business. There were concerns that tools like Gemini and AI Overviews might hinder traditional search methods and cut into advertising revenue. However, Google’s impressive performance of $100 billion this last quarter indicates that rather than replacing conventional search, AI is boosting the demand for information. It seems Google is enhancing user engagement with smarter, more interactive tools that keep people glued to its platform, as reported by Yahoo Finance.

Enhance Your Investment Game:

- Check out TipRanks Premium and enjoy 50% off! Access an array of powerful investing tools, detailed data, and insights from expert analysts to invest wisely.

As a consequence, shares of Alphabet surged by 5% following the latest earnings report, demonstrating that Google can manage extensive AI investments effectively while growing its profitability. Analysts have lauded the company for its innovation and strong financial results. For instance, Morningstar highlighted the rising popularity of Gemini, which has attracted over 650 million users. Additionally, Wedbush noted that the company appears to have navigated past legal troubles and is on solid footing in the AI race.

Moreover, Alphabet has raised its full-year capital expenditure forecast to $93 billion in light of the strong demand for AI services. Notably, CFO Anat Ashkenazi mentioned that there’s already a strong customer interest for more AI offerings than the company can currently meet, which is definitely a positive predicament to be in. Analysts also expressed optimism about long-term potential from early investments in pioneering projects like Waymo and quantum computing.

Should You Buy Google Stock?

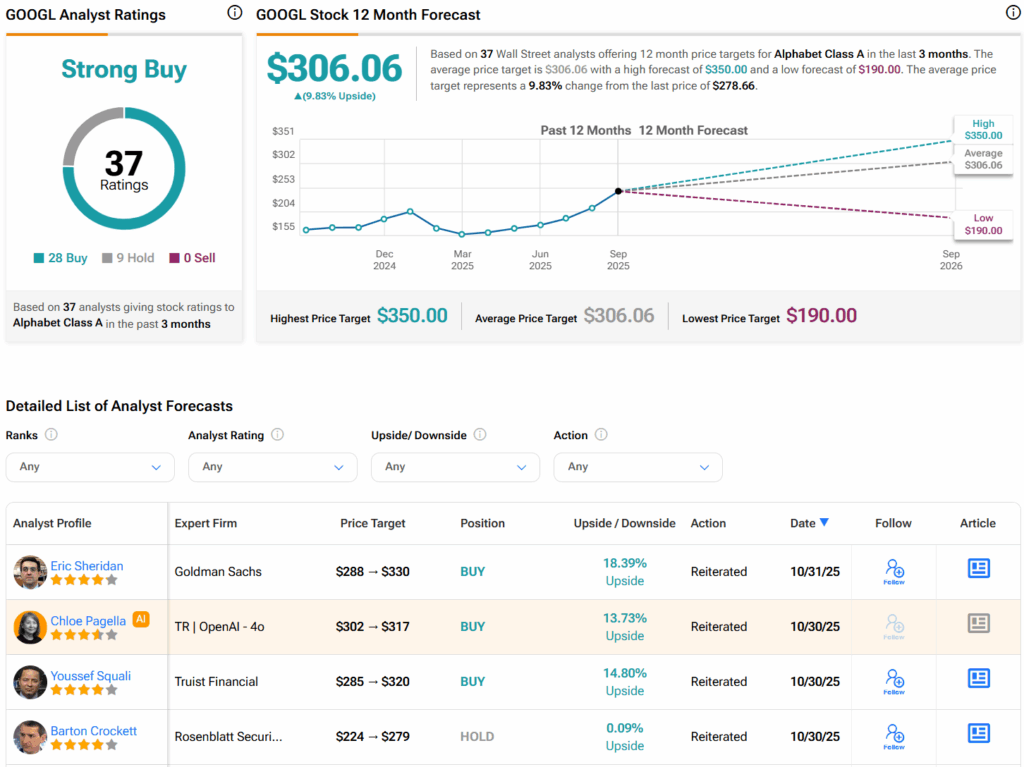

On Wall Street, analysts have established a ‘Strong Buy’ consensus for GOOGL stock, with 28 Buy ratings and nine Holds given in the past three months. The average target price for GOOGL stands at $306.06 per share, indicating an upside potential of 8.2%.

Explore more analyst ratings for GOOGL

Disclaimer & DisclosureReport an Issue