The U.S. Attorney’s office is pushing for a hefty sentence for Matthew Billingsley, a former Fresno restaurant manager who now finds himself on the wrong side of the law. They are recommending he serve 11 years in prison and pay back investors a whopping $12.5 million.

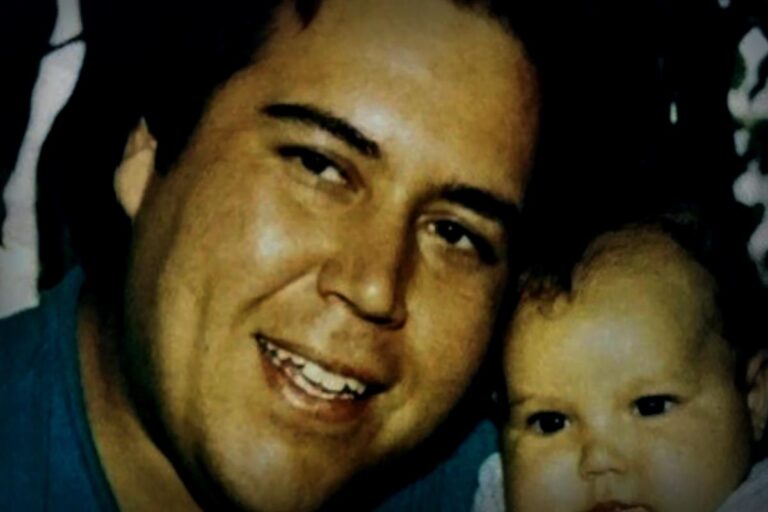

This 39-year-old, who previously managed Dog House Grill on Shaw Avenue, stands accused of swindling banks and investors out of around $30 million through an elaborate, yet ultimately doomed, investment scheme that lasted from June 2018 to February 2023.

Back in August, Billingsley confessed to one count of wire fraud. Although his sentencing was supposed to take place on Monday, it’s now rescheduled for December 8 in front of U.S. District Judge Jennifer L. Thurston.

His crime could land him in prison for as long as 20 years with a fine of $250,000. However, prosecutors, together with the probation department, have suggested a lighter punishment of 135 months—about 11.2 years—along with three years of supervised release and an order to repay $12,504,769.27.

Nearly Five Years of Deception

Billingsley’s attorney, Daniel Bacon, is seeking a lighter sentence of just five years and asks for less in restitution—$10,275,385. He argued that his client took responsibility for his actions and even managed to pay back some of his investors.

Moreover, Bacon took issue with the prosecution labeling Billingsley’s scam as “sophisticated,” which carries harsher penalties. He argued that while Billingsley did forge documents, the scheme wasn’t as complex as portrayed by the government.

On the other hand, prosecutors presented a compelling case. Using victim testimonies and correspondence between Billingsley and an accomplice, they demonstrated how he maintained the scheme for years until it imploded.

One statement summarized the matter well: “The defendant took millions from victims. He made deliberate choices to commit fraud over nearly five years, altering documents, forging signatures, and lying to get his way.”

Frustrated Victims Speak Out

Recent court documents included statements from several investors who reported money lost, ranging from $2.3 million to smaller amounts like $200,000.

These individuals expressed their outrage at being played for fools by Billingsley, who comes from a family known for their beloved restaurant chain famous for tri-tip sandwiches. Their establishments can be found in areas like Cambria, San Luis Obispo, Fresno, and Bakersfield.

One particularly enraged investor shared their thoughts: “I heard he’s going to tell the court why he stole from me. Let’s be real, he’s no victim here. What matters is that he pays back every dollar he took, plus interest and my legal fees. He can ponder his choices while serving time for his actions.”

Another concerned investor lamented how a lost $50,000 investment upended their family’s life, stating: “We’re facing serious financial issues now and struggle to keep our home. This loss has crushed us. Our lives are filled with stress and uncertainty, and it’s taking a huge toll on our ability to afford basic living expenses.”

During the probe, federal investigators got a search warrant to seize text exchanges between Billingsley and a co-conspirator, who has yet to face charges.

One shocking text revealed that they were worried about an investor’s health, saying: “(Victim) had a massive heart attack and is in a coma. What does that mean for the loan?”

Another reply read, “We just need to find someone else.”