Overview

This past Friday, Netflix announced its massive agreement to acquire Warner Bros., which encompasses the film and television studios alongside HBO Max, for a staggering $82.7 billion. This acquisition comes on the heels of an intense bidding contest where Netflix emerged victorious over competition from both Paramount and Comcast.

Highlights

Netflix shared in a press release that this all-cash-and-stock transaction is valued at $27.75 per share of Warner Bros. Discovery. The deal will finalize after establishing Discovery Global, a separate public entity spun off from the media giant’s TV network business.

Regulatory clearance is needed, and the transaction is tentatively expected to conclude in the third quarter of 2026.

If approved, shareholders of WBD will receive a payout of $23.25 in cash and $4.501 worth of Netflix shares for each share they hold.

Various reports indicate that Paramount Skydance had previously offered $27 per share to take over all assets of Warner Bros. Discovery, which includes channels like CNN and TNT.

Comcast submitted a bid focused solely on acquiring Warner Bros. Discovery’s studios and streaming operations.

Furthermore, it has been reported that Netflix guaranteed a hefty $5 billion break-up fee in case regulators block the deal.

Market Reactions to the Warner Negotiations

In premarket trading on Friday, shares of Warner Bros. Discovery leveraged grew by 1.22%, reaching $24.84, while Netflix’s shares dipped by 2.33% to $100.81 after a previous decline of 0.71% on Thursday.

Details on Paramount’s Proposal

Sources from Bloomberg and Variety noted that Paramount Skydance is crying foul over how the sale is being managed, referring to it as ‘tainted.’ In a correspondence addressed to Warner’s CEO, David Zaslav, Paramount’s legal team alleged that the negotiating process appeared biased toward Netflix. This December 3 letter criticized Warner for straying from a fair sale process, imperiling all stakeholder interests.

Antitrust Concerns

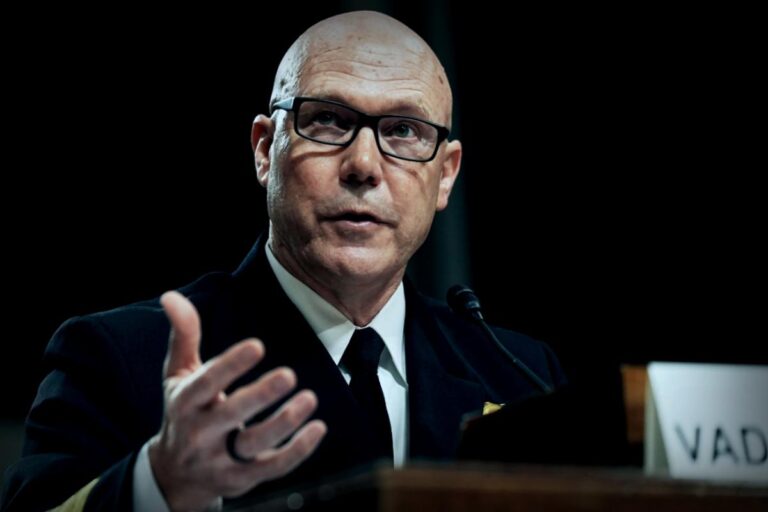

The New York Post recently reported that important officials in the White House flagged potential antitrust issues with Netflix’s acquisition objective. Allegations were also raised regarding Netflix’s significant market leverage warranted further investigations. Moreover, it was disclosed that Paramount Skydance’s CEO David Ellison met with Trump-affiliated lawmakers to voice opposition against Netflix’s pursuit of Warner.

Background Info

In June, Warner Bros. Discovery declared its intentions to split into a pair of publicly traded units, intending to establish a ‘Streaming & Studios’ firm while another unit will manage traditional cable networks like CNN and TNT. However, after diverging from existing interests, they received several offers from various parties looking to capitalize on Warner’s established market presence.