Overview

-

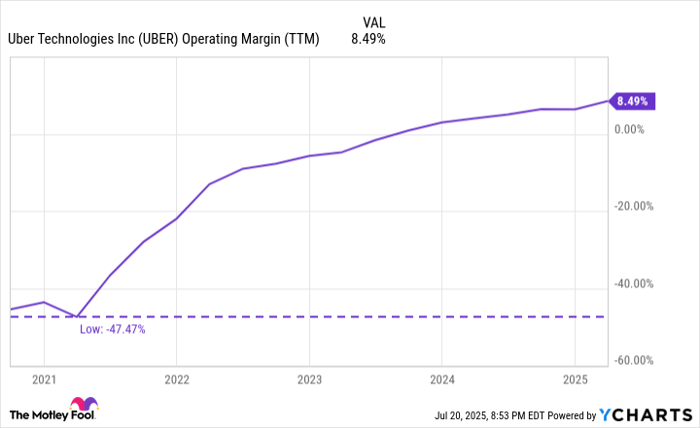

Uber’s profit margins have shown consistent growth in recent years.

-

Roblox’s revenue showed a thrilling 30% increase thanks to a standout game release.

- Here are 10 stocks we prefer over Roblox

The tech sector, after a shaky start to the year, is enjoying a solid comeback. The Nasdaq Composite, heavily focused on technology, has seen an impressive 28% increase in the last three months. So, which tech stocks should investors be paying attention to? I’ve got two personal favorites that look promising.

Wondering how to invest $1,000 wisely? Our team of analysts has uncovered the 10 top stocks perfect for investment right now.Find out more >

Uber Technologies

First up is Uber Technologies (NYSE: UBER). Right now, there’s a lot of buzz around self-driving cars, with companies like Tesla and Waymo (part of Alphabet) expanding their robotaxi services in various locations like Austin and Phoenix.

You might wonder: Is it still a good idea to invest in Uber when the era of self-driving cars seems so close? Some influential figures think otherwise. For instance, billionaire Bill Ackman, founder of Pershing Square hedge fund, has expressed his confidence in Uber’s stock, claiming it is undervalued and potentially “a massive discount to its intrinsic value.”

Ackman and others see self-driving vehicles not as a competitor to Uber’s ridesharing, but rather an opportunity. As viable autonomous vehicles start becoming more common, Uber could reduce operating costs significantly, thus widening its margins and expanding its user base.

Imagine this: Currently, driver costs are Uber’s largest expenditure. If they diversify with AVs, substantial savings could boost profitability. Over the past five years, Uber’s operating margin has jumped from a hefty negative 47% in 2021 to a respectable 8%.

Additionally, as costs drop, Uber can invite new users who find the current pricing too high. They might also venture beyond ridesharing, venturing into deliveries and freight services.

Overall, with the deep blue technological innovations, Uber appears to be a solid long-term investment choice for tech investors.

Roblox

Next in line is Roblox (NYSE: RBLX). Currently, its stock has skyrocketed by about 115% this year! Clearly, they’re riding a wave fueled by tremendous enthusiasm around their new game, Grow a Garden. Is there more to come? I believe so!

Roblox provides a platform for gamers and independent developers alike, where the majority of its games are free. That said, most of its earnings come from players purchasing Robux, an in-game currency for buying items.

The success of games on Roblox isn’t just fun and games—it’s crucial for the company’s financial well-being. Grow a Garden, which launched in March, saw 21.3 million players at one point in June, wrecking the previous high held by Fortnite at 14.3 million concurrent users.

Roblox hopes to leverage this newfound popularity to achieve even greater success. The company’s latest quarterly earnings already indicated a 30% growth. With the upcoming earnings report set for July 31, all eyes will be on them!

Regardless of how the earnings turn out, I’m confident in Roblox’s long-term performance. They’ve built a solid base of loyal fans, which should fortify them even if the latest game’s hype subsides. Investors would be wise to consider Roblox a stock to add to their portfolios in 2025 and beyond.

Thinking About Placing $1,000 in Roblox?

Before making that leap, remember this:

The Motley Fool Stock Advisor team just picked their idea of the 10 best stocks to invest in right now— and surprisingly, Roblox didn’t make the list. The other recommendations have high potential for spectacular returns down the road.

Reflect back to when Netflix hit their recommendation list back on December 17, 2004. An investment of $1,000 at that time would be worth a whopping $634,627 today!* The same trend is seen with Nvidia; it gained over $1,000 if bought after its recommendation in 2005.*

On a final note, Stock Advisor has impressive overall returns of 1,037%, which significantly outshines the S&P 500’s 182%. Don’t overlook their latest hot picks, accessible when you sign up for Stock Advisor.

Discover the 10 top stocks >

*Performance data from Stock Advisor as of July 21, 2025

Suzanne Frey from Alphabet’s board is on the board of The Motley Fool. Jake Lerch has stakes in Roblox, Tesla, and Alphabet. Note that The Motley Fool owns shares in and recommends Alphabet, Roblox, Tesla, and Uber Technologies, which follows their standard disclosure policy.