Physical AI is all about integrating current AI technology with machines and robots capable of real-time learning and interaction. In essence, this is where the future of AI lies.

It’s crucial to recognize that while we may not have full-scale implementations yet, exciting tech such as Automated Vehicles (AVs) and advanced warehouse systems are just around the corner, ready to revolutionize entire industries. Smart investors can look forward to considerable returns as technology continues to evolve. In this post, we’ll explore five notable companies that stand to gain as Physical AI takes off into 2025 and beyond.

NVIDIA: The Unrivaled AI Leader

NVIDIA (NASDAQ: NVDA) has established a dominant position in the AI arena, thanks to their groundbreaking GPU technologies. They kicked off the AI revolution in data centers, and their proactive approach in expanding into newer fields ensures they’ll stay at the forefront.

The significance of NVIDIA’s tech in Physical AI can’t be overstated; the entire ecosystem, from GPUs to models and trained applications, begins with them. Currently, the company is actively working on transformative projects in various sectors, including automotive, robotics, and smart city applications.

The future looks bright for NVIDIA, given that its stock seems undervalued against long-term earnings predictions, suggesting a potential value increase of 200% over the next ten years.

AMD: Pioneering AI at the Edge

Advanced Micro Devices (NASDAQ: AMD) is another key player in the AI landscape, aiming to close the gap with NVIDIA. Now, AMD is strategically positioning itself within the Physical AI landscape.

The company is on the verge of capturing market share in the GPU realm and data centers, boasting superior performance and monitoring capabilities. They’re also facilitating an expansion of AI applications to edge technologies.

With unique technological advances in their Ryzen line, enhanced with neural processing units, AMD delivers AI capabilities across numerous devices, making it an essential contributor to the Physical AI sector. Mid-2025 pricing shows AMD stock is considerably undervalued, with predictions for a potential triple-digit increase spanning the next five to ten years.

Tesla: Beyond the Hype, Into the Future

Tesla (NASDAQ: TSLA) might be navigating through some rough waters in 2025, from CEO Elon Musk’s public relations challenges to fierce competition; nevertheless, the electric vehicle pioneer continues its profitable trajectory and consistent future investments.

Looking ahead, Elon envisions the future dominated by AVs, especially with the forthcoming Cybercab model—a totally autonomous vehicle devoid of traditional controls, aiming to be foundational for ride-sharing fleets.

It’s worth mentioning that these vehicles are set to launch in 2026 and are just one piece of Tesla’s contribution to Physical AI. The company is also making strides with the development of the Optimus robot, now actively engaged in operations across various factories.

Tesla’s market value appears inflated presently, yet considering longer-term prospects, it hints at a potential 100% growth rate over the next several years.

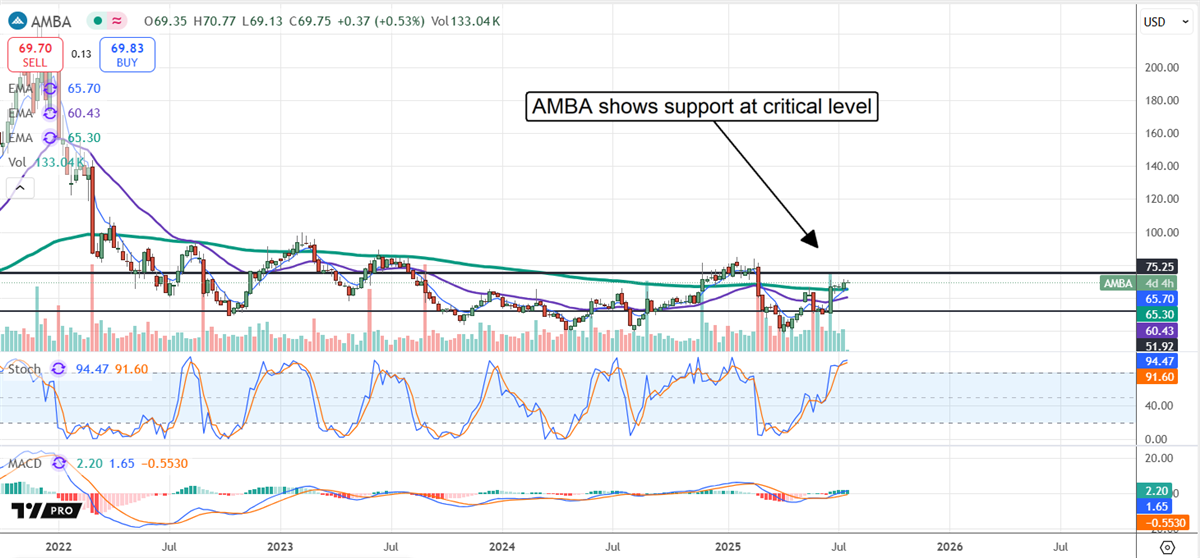

Ambarella: The Visual Innovator of Physical AI

Ambarella (NASDAQ: AMBA) has undergone a strategic shift to become the “eyes” for Physical AI. Transitioning from a simple image processor to a leader in computer vision, they now focus on edge computing solutions.

Ambarella’s semiconductor solutions empower high-quality video processing and analytics straight at the source, enabling quick decision-making in sectors like AV, aerospace, and manufacturing.

After a successful pivot back into growth in 2024, Ambarella is slated to sustain this trajectory with high growth rates expected for the next decade while improving profit margins. Like other stocks mentioned, Ambarella also holds significant upside potential, projected to rise by 100% if market forecasts are conservative enough.

Symbotic: Revolutionizing Supply Chain Management

Symbotic (NASDAQ: SYM) has been crafting an AI and robotics journey that sees their systems enhancing supply chain operations for retail giants like Walmart and Amazon.

Its comprehensive solutions address challenges at all supply chain levels, paving the way for increased efficiency and precision while minimizing environmental impact and space requirements.

What’s getting buzz in 2025 is the execution of a massive backlog, with figures exceeding $23 billion reported as of the latest earnings update.

What’s Your Next Investment Move?

Before making any trades, it’s wise to consider what the top analysts are spotlighting as great investment opportunities currently. Keeping track of trusted market research, MarketBeat is essential for navigating investments successfully.

A team of experts has recently spotlighted five standout stocks that they recommend for immediate consideration—these top picks are being whispered around as the broader market begins to take notice.

Discover these five investment opportunities here.