Axon Enterprise, Inc. (AXON) is definitely making waves in the public safety technology domain with its cutting-edge AI-driven software. Their AI tools are crafted and launched via the Software & Services segment, which is integral for arming safety professionals with technology that boosts response times and decreases risk levels.

This branch has proven to be a crucial factor for Axon, with its revenue soaring by 39% year-on-year in the first quarter of 2025, following a substantial 33.4% jump in 2024. An ever-increasing number of agencies are embracing Axon’s AI solutions that optimize workflows and enhance on-ground decision-making.

One standout innovation from Axon is the Draft One, an AI-enhanced report-writing assistant that enables officers to create reports quicker and with greater accuracy, allowing for more time to connect with the community. With almost 30,000 users currently active, it’s definitely among Axon’s hottest software offerings. Another notable tool is the Redaction Assistant, which utilizes AI to automatically obscure sensitive details in video evidence, slashing redaction time by as much as 75%.

These offerings come bundled in premium subscriptions like the Officer Safety Plan 10 (OSP 10), which is gaining a solid customer base. With around 70% of Axon’s U.S. customer base still using basic plans, there’s a huge opportunity for upgrades on the horizon.

As Axon continues to strengthen its AI capabilities and encourage adoption of its Software & Services, it’s geared up to significantly contribute to creating safer and more interconnected communities shortly.

A Look at AXON’s Competitors

In comparison to major competitors, Kratos Defense & Security Solutions, Inc. (KTOS) saw its Government Solutions segment achieve a 10% year-over-year revenue rise in the first quarter of 2025, bringing in $239.5 million. This surge can be attributed to increased sales across Kratos’ business lines, particularly the C5ISR, Defense Rocket Support, and Microwave Products sectors, making up 79.1% of total revenue in the quarter.

Teledyne Technologies Incorporated (TDY) also reported a 2.2% year-over-year revenue growth to $757 million from its Digital Imaging segment in the first quarter of 2025. This increase came from higher sales in Teledyne’s commercial infrared imaging systems and surveillance technology, with this segment accounting for 52.2% of total revenues during the quarter.

AXON: Stock Performance, Valuation, and Forecasts

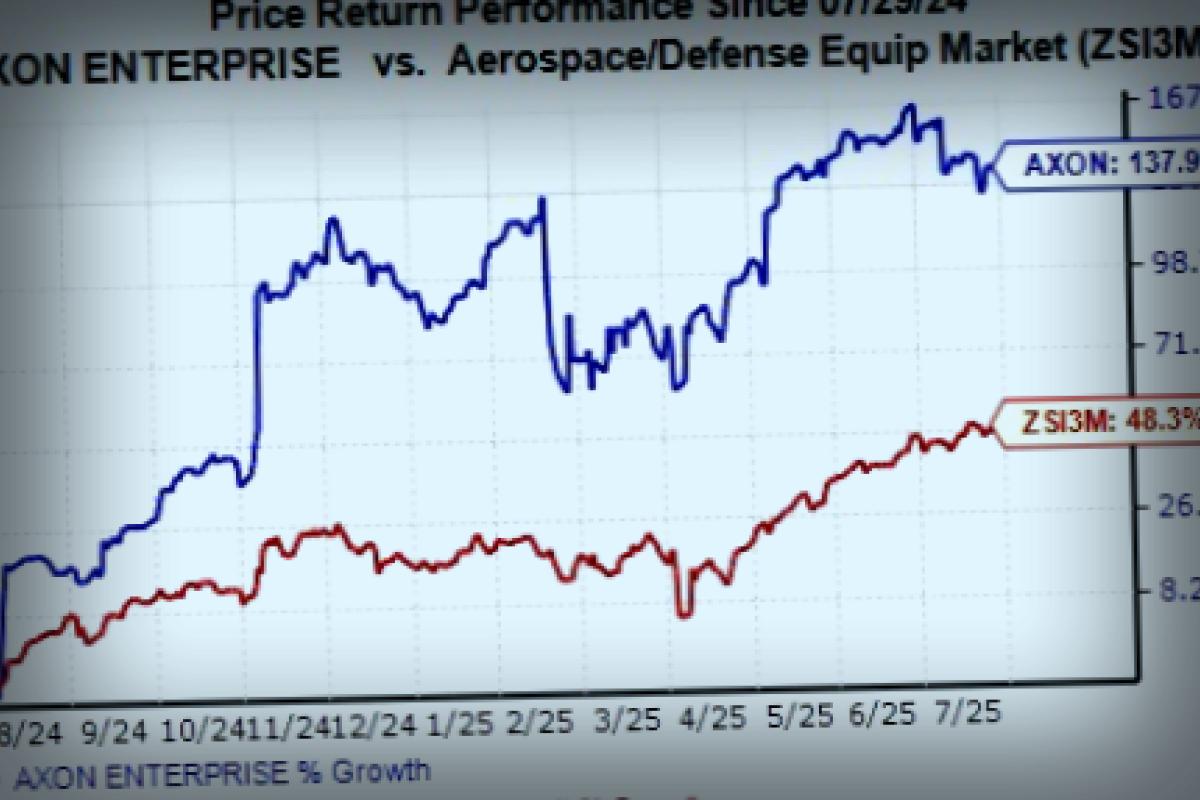

When it comes to stock performance, Axon’s shares have impressively jumped by 137.9% in the past year, outpacing the industry’s average growth of 48.3%.

Image Source: Zacks Investment Research

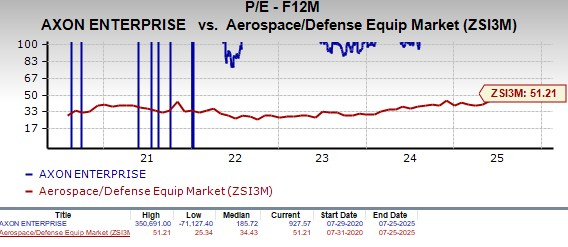

In terms of valuation, AXON trades at a staggering forward price-to-earnings ratio of 925.57X, which well exceeds the industry average of 51.21X. The company holds a Value Score of F.

Image Source: Zacks Investment Research

Promisingly, the Zacks Consensus Estimate for AXON’s earnings in the second quarter of 2025 has seen a positive uptick in the past two months.

Image Source: Zacks Investment Research

The company currently holds a Zacks Rank of #3 (Hold). You can check out the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article was first published on Zacks Investment Research (zacks.com).