The Enforcement Directorate (ED) from Surat has officially submitted a charge sheet in a special court, accusing five individuals of various cybercrimes and fraudulent schemes under the Prevention of Money Laundering Act (PMLA).

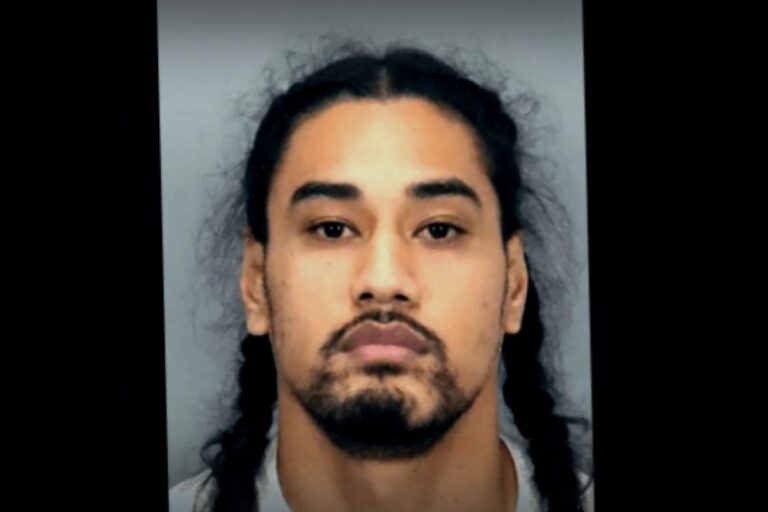

In their announcement, the ED highlighted that the total proceeds from the identified crimes amount to around ₹104.15 crore, which is about $11 million. Those implicated in this case include Makbul Abdul Rehman Doctor, Kaashif Makbul Doctor, Mahesh Mafatlal Desai, Om Rajendra Pandya, and Mitesh Gokulbhai Thakkar. Allegations assert that this group has been running illegal cyber activities throughout India since its inception.

Enforcement Directorate’s Legal Steps

The ED’s report indicated that these accusations stem from investigations by the Surat Police’s special operations group (SOG). Notably, one of the primary suspects, Bassam Doctor, is currently evading capture and believed to be hiding in an unnamed Arab nation. The ED suspects that he serves as the final beneficiary of the fraudulent gains, particularly through transactions linked to his crypto wallet.

Further examinations of seized devices and financial records have revealed extravagant spending behaviors among the accused, including large sums spent on various e-commerce platforms with the ill-gotten gains. Arrests of four suspects took place after inquiries launched in October 2025, along with the seizure of properties valued at nearly $1 million tied to the case.

The criminals are alleged to have executed their scams using misleading investment tips and scams centered around digital assets. They tricked victims by sending out fraudulent communications masquerading as notices from legitimate agencies like the ED, TRAI, and CBI to persuade victims into giving up their money and assets. This group’s operations included a ruse involving a fake police station where individuals in police uniforms misled unsuspecting victims.

Police Advisory for Public Vigilance

Additionally, the fraudulent group was noted for creating counterfeit documents as proof of penalties settled. The ED remarked that multiple dubious notices were found during the investigations. The stolen funds were deposited into accounts of unassuming individuals passing basic Know-Your-Customer (KYC) measures, known as mule accounts. These accounts are frequently maneuvered to circulate illicit assets before transitioning to other forms, including digital cryptocurrencies.

To complicate investigations further, the criminals have been reported to associate fake SIM cards with their schemes. Meyerporters trail the funds through standard banking systems before cash withdrawals and usage of various hawala channels, severely hindering law enforcement’s efforts to trace the transactions accurately.

Amidst this rising tide of digital fraud, Indian authorities have cautioned citizens about the increasing prevalence of these kinds of scams. The police have advised individuals to exercise caution when sharing personal details online and encouraged professional advice for any questionable online investment proposals.