By Tom Sims

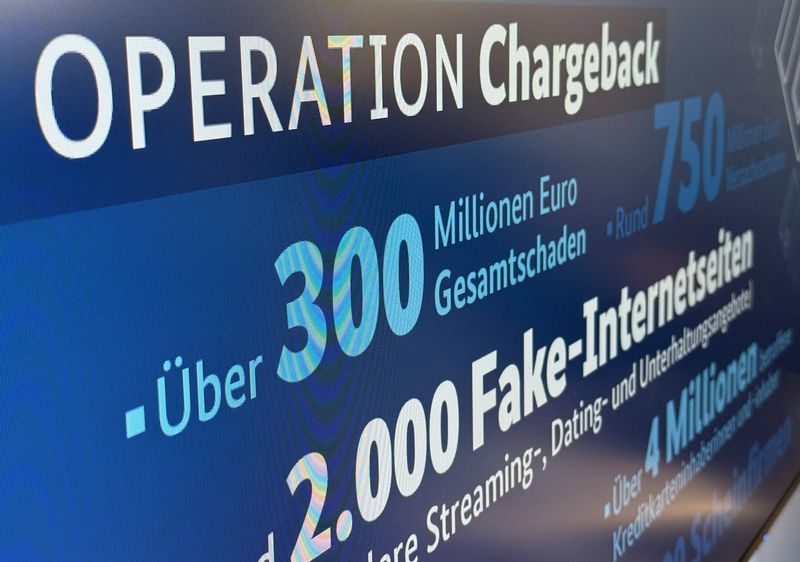

WIESBADEN, Germany (Reuters) – In a significant crackdown on online crime, German authorities announced on Wednesday the arrest of 18 individuals connected to a broad investigation targeting internet fraud and money laundering networks exploiting payment service providers.

A staggering 44 suspects are under scrutiny, which includes six former workers from prominent German payment services. This alleged operation has impacted approximately 4.3 million victims across 193 countries through stolen credit card details, according to law enforcement sources.

Using phishing schemes, the suspects managed to pilfer personal information and subsequently established unauthorized subscriptions for fake adult and dating websites, resulting in a financial fallout of over 300 million euros, reported officials at a press conference.

The Financial Industry Facing Setbacks

This latest scam has struck a new blow to the integrity of Germany’s financial sector, notably five years after the notorious Wirecard scandal shook the market.

Prosecutor Harald Kruse emphasized the seriousness of the situation, stating, “The accused had ties to four major German service providers, impacting a significant portion of the financial industry. This highlights the importance of our investigation.” Despite this, officials have opted not to publicly disclose which payment firms employed the arrested individuals. However, sources indicate that companies such as Unzer and Nexi are implicated.

Unzer confirmed through a statement that it severed ties with the involved businesses back in 2021, asserting, “The investigations do not involve any current employees of ours.” Similarly, Nexi indicated that it had already “proactively terminated all relevant business relationships” in the same year.

Prosecutor Susanne Schueler criticized the former employees for poor judgment in initiating relationships with questionable companies and their subsequent negligence in monitoring transactions.

This expansive investigation underscores the blurred lines between cybercrime and white-collar fraud, indicated authorities.

Daniel Thelesklaf, head of Germany’s Financial Intelligence Unit, pointed out, “What began as one-off small withdrawals has evolved into a major global enterprise with structured professional connections. We now witness what financial crime has become in 2025: it’s international, digital, and collaborative.”

Details regarding the arrested individuals have yet to be revealed.

Until late Tuesday, news regarding this investigation was kept quiet, leading up to a coordinated search operation that spanned Germany, Italy, Canada, Luxembourg, the Netherlands, Singapore, Spain, the U.S., and Cyprus.