The Federal Reserve has opted to maintain its interest rates as they are, doing so just after President Donald Trump made his surprise appearance at the bank and pushed for a rate reduction.

Trump has publicly criticized the Fed for several months now, but the central bank has chosen a ‘wait-and-see’ stance while it assesses the impact of tariffs on the economy.

On Wednesday, the Federal Open Market Committee (FOMC) mentioned that the “uncertainty surrounding the economic outlook remains significant.” This shows their cautiously optimistic perspective.

Interestingly, two members of the Fed — Michelle Bowman and Christopher Waller, both appointed by Trump — disagreed with the majority verdict, advocating for a 0.25% rate cut, marking a notable dissent as it’s the first time since 1993 that two governors voted against the majority.

It’s been quite a while, about seven months and five meetings, since the Fed last made any changes to the interest rates, which currently linger between 4.25% and 4.5%. This steady rate is a holdover from increases made to tackle inflation following the pandemic.

Just hours prior to this decision, a government report revealed economic growth exceeded expectations for the three months leading to June, although this strong performance was influenced by a statistical oddity.

Typically, robust economic growth reduces the urgency for the Fed to lower interest rates because consumers and businesses appear able to manage higher borrowing costs without issue.

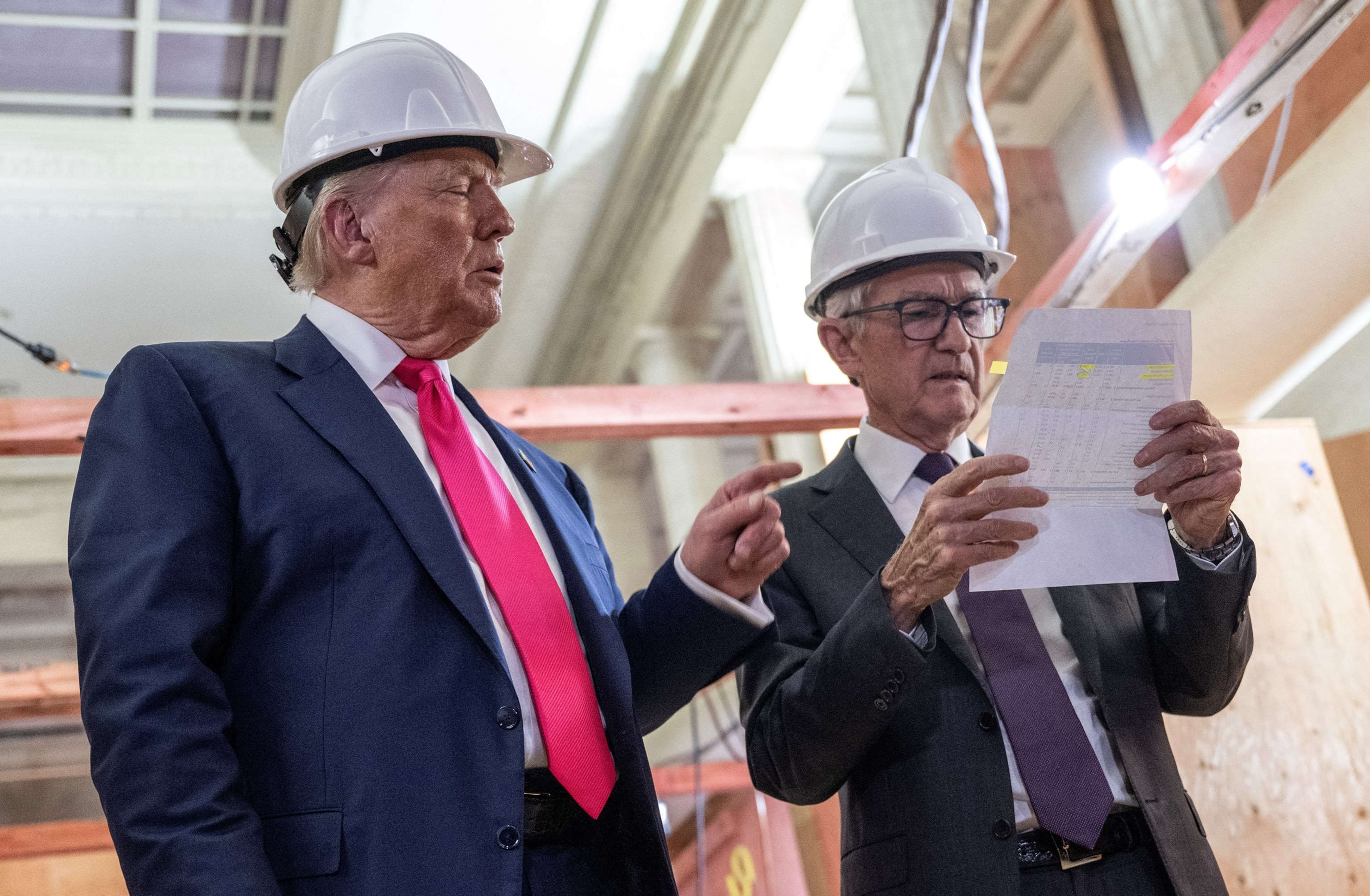

Trumps’ repeated suggestions to the Fed revolve around lowering rates to boost economic activity and ease government debt interest payments. Last month, he expressed frustration with Fed Chair Powell, quipping, “We have a man who just refuses to lower the Fed rate. Maybe I should go to the Fed. Am I allowed to appoint myself? I’d do a much better job than these people.” Despite Trump’s musings, the Federal Reserve is an independent entity restricted from such appointments by law.

Recently, Trump has also criticized the Fed regarding cost overruns on a $2.5 billion renovation project. The Fed has defended these expenditures, stating that unforeseen cost increases have affected the project but will ultimately lead to long-term savings by streamlining operations within their building.

While federal rules allow the president to dismiss the Fed chair for “cause”, such an action has never taken place, and Powell’s leadership is set to continue until his term ends in May 2026.

The Federal Reserve’s responsibilities center on controlling inflation and maximizing employment. Lowering interest rates theoretically can stimulate the economy and enhance job growth, primarily while maintaining inflation at manageable levels.

However, the Fed has projected potential inflation concerns arising from high tariffs. Typically, importers offset tariff costs by raising prices on consumers.

While allegations of tariffs contributing to inflation have been made, analysts have previously pointed out that increases in housing and food prices are primarily attributable to factors other than tariffs.

Despite taking a patient approach, last month the Fed forecasted that two quarter-point interest rate cuts could still happen throughout 2025, continuing a bearish outlook voiced earlier.

Around the same time, Powell mentioned that he wouldn’t dismiss the possibility of an interest rate cut happening at the upcoming July meeting. “I wouldn’t take any meeting off the table or put any on the table,” he said at an event hosted by the European Central Bank in Sinatra, Portugal, indicating that future decisions depend heavily on evolving economic data.