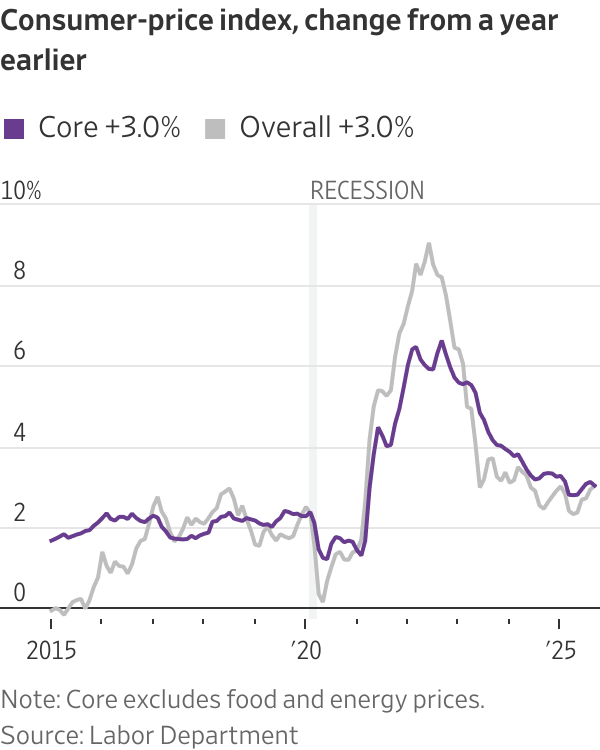

Inflation saw a small uptick in September, landing at 3%, but it didn’t quite hit the forecasts set by economists. This gives the Federal Reserve a straightforward outlook for the likely interest rate cuts as we move into their upcoming meetings this year.

According to the Labor Department’s report on Friday, consumer prices increased by 3% compared to last year. That’s a little higher than the 2.9% we saw in August, marking the most rapid growth since January. The core prices, which exclude the often-volatile food and energy sectors, also rose by 3%. However, this still came in lower than the expected 3.1% due to some easing in housing costs.

Inflation keeps being a hot topic, with prices above the ideal range that officials are aiming for. Retailers are continuing to pass on some of the costs from tariffs to buyers, which is raising prices on goods like clothing and equipment for sports.

Interestingly, the new figures are sounding less alarming than officials anticipated back in the spring when President Trump enforced significant tariffs. For context, the U.S. raked in approximately $30 billion in tariff revenues just in September, yet many companies haven’t pushed those increased costs onto consumers. Some have managed to avoid the hit from tariffs by using loopholes.

With September’s data, the Fed seems set to lower interest rates again during next week’s meeting as they manage a slowdown in hiring. If this slower price growth trend continues, it may make it easier for them to cut rates, reducing the concerns from those who are more worried about inflation levels.

In fact, stock markets reacted positively to the news on Friday.

James Knightley, ING’s chief international economist, commented on this saying, “While tariff-related inflation remains a challenge for now, the jobs market is surfacing as a more urgent issue for the Fed, suggesting a shift toward a ‘no fire, let’s fire’ economy branding.”

This report came out more than a week late due to a government shutdown affecting the gathering of economic data. The decision was made to still release the inflation stats as they’re essential for adjusting Social Security payments. However, jobs data is still pending.

On social media, the White House mentioned Friday that due to the shutdown, there likely won’t be any update for October’s inflation. This is because the surveyors collecting price data are unable to do their jobs. White House press secretary Karoline Leavitt attributed the September figures to Trump’s economic policies.

From August to September, prices climbed by 0.3%, which was lower than the anticipated 0.4%. Core prices experienced a 0.2% rise as well.

However, certain industries sensitive to tariffs witnessed significant price movements. Apparel saw a 0.7% jump, marking the biggest monthly increase in a year, while furniture and bedding went up by 0.9%, and sporting goods rose by 1% from August.

Moreover, energy prices surged within the month, particularly gasoline, while food prices grew at a slower rate than they had in August.

Bill Adams, chief economist at Comerica Bank, stated that inflation continues to be frustrating for consumers. He highlighted that coffee, heavily affected by tariffs, saw an 18.9% jump in price over the year, and beef costs rose by 14.7%. A decline in used car prices was also observed, suggesting financial stress on lower-to-middle-income families who are cutting back on buying.

The September inflation was slightly cooler than anticipated from economists, attributed to unexpectedly minimal rises in rent and housing costs. The housing market is feeling the pinch from high-interest rates along with increased post-pandemic apartment developments.

Adams also indicated that the Trump administration’s crackdown on immigration could be driving up prices in some service areas that rely on immigrant labor. For instance, the costs for gardening and lawn care surged 13.9% year-over-year, and systems caring for the disabled and elderly at home also spiked by 11.6%. Of note, the decrease in housing demand due to reduced immigration could help ease housing costs in the short term.

Survey data shows inflation very much on the minds of many Americans. The University of Michigan’s consumer-sentiment index dropped to 53.6 in October from 55.1 in September, reflecting complaints about persistently high prices.

Thierry Wizman, an interest rate and foreign exchange strategist at Macquarie, remarked that the latest report displays “sticky” inflation and offers scant justification for more aggressive rate cuts from the Fed, asserting, “I don’t believe there’s much good news here.”

As for job growth, employers added just 22,000 positions in August, based on the last available data from the Labor Department. Recent info from Bank of America, the payroll company ADP, and other studies indicate hiring has remained sluggish throughout September.

The government shutdown, now extending into its fourth week, and the hold on economic data have made it challenging for officials to assess the concurrent risk of inflation remaining high while job growth is slow.

While there are gaps in data, private assessments are helping fill the void. The S&P Global Flash U.S. Composite PMI—a monthly measure of manufacturing and service activity—soared to 54.8 in October, up from 53.9 in September, per a Friday survey. Employment picked up as well in October.

According to this survey, input costs inflation saw a slight uptick in October, although many businesses—stemming from both manufacturing and service sectors—reported struggles in passing those higher costs onto consumers amid subdued demand and fierce competition.

If you want to reach out, you can get in touch with Konrad Putzier at konrad.putzier@wsj.com and Harriet Torry at harriet.torry@wsj.com