Recently, investors have started to reevaluate some of the hottest market stocks like never before since the infamous ‘Liberation Day.’

Last Friday’s market slump—triggered by President Trump’s latest warning regarding “massive” tariffs on imports from China—wasn’t catastrophic by past standards. However, it impacted a wide range of rising tech stocks and smaller banks, leading some analysts and portfolio managers to feel uneasy. They had believed up until then that the sweeping advances in the market by 2025 were safe from trade-related disturbances.

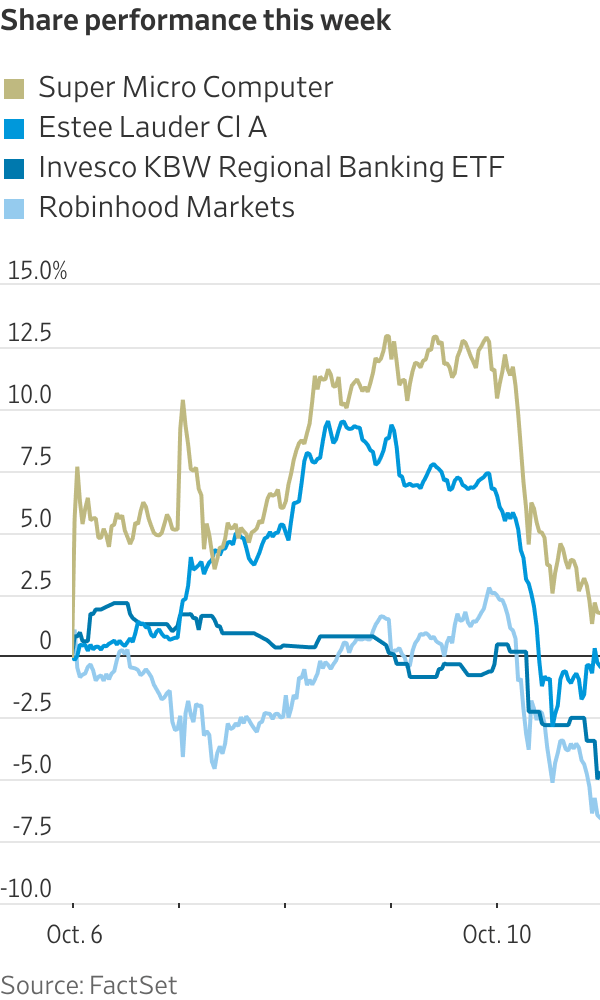

This decline leaves many investors feeling uneasy. Stalwarts like Nvidia and Robinhood maintain strong businesses, and there are high expectations surrounding tax cuts, impressive earnings, and decreasing interest rates aiding both companies and consumers.

However, this sharp downturn exposes concerns that the tech industry is still susceptible to political changes, while the banking sector’s decline hints at deeper fears about the economic stability amid a renewed trade clash with China.

Initially, stocks were on track to set new highs early Friday. But Trump’s mid-morning social media post came in response to China’s announcement of new export restrictions on rare earth materials—crucial for semiconductors, electric vehicles, and military jets—which derailed momentum.

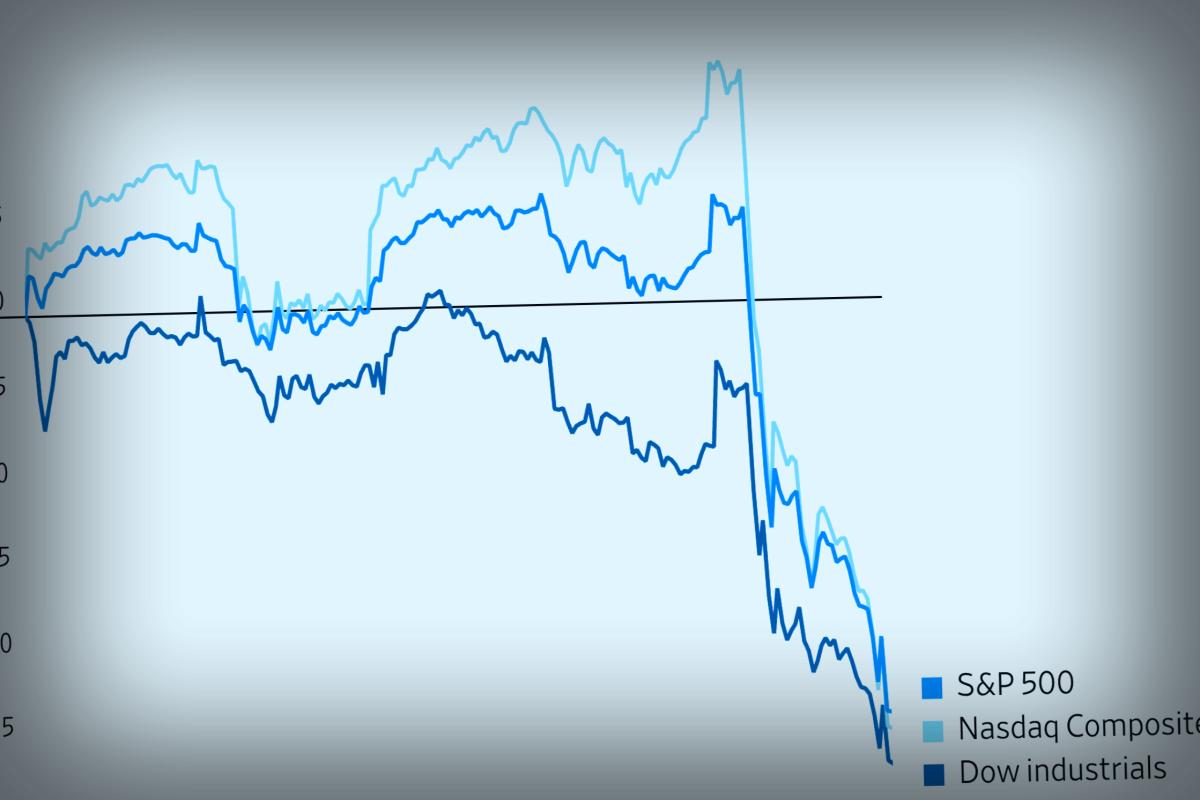

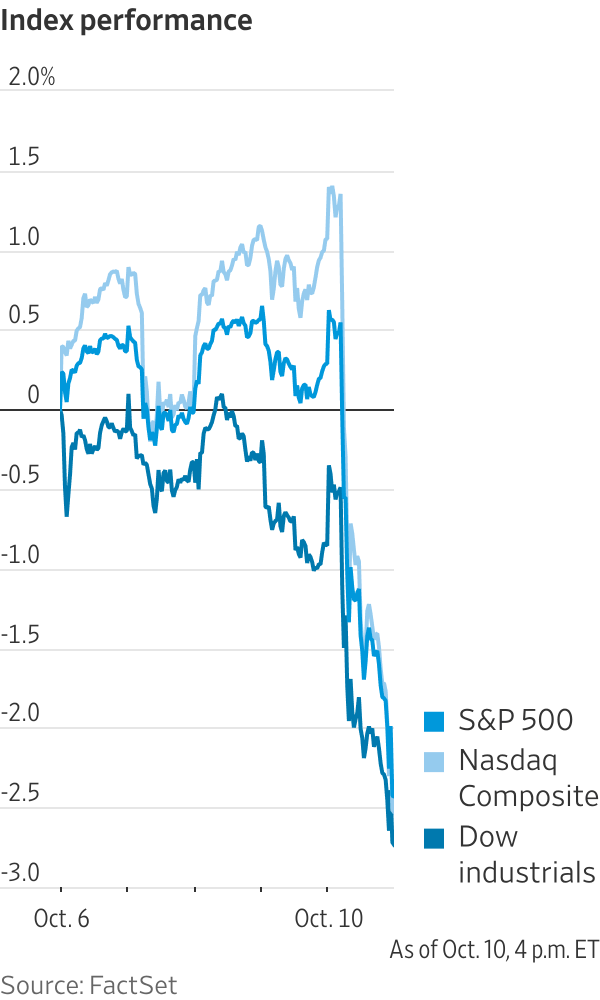

This sent the S&P 500 to its greatest decline since the chaotic market conditions in April due to previous tariffs, erasing all of its gains from the week and then some. Economic worries pulled down prices for both copper and oil, and the CBOE Volatility Index, often termed as Wall Street’s “fear barometer,” surged about 30%, raising alarm that increased market fluctuations could be uncovering hidden weaknesses after months of calmness.

After months of continuous market growth despite persistent threats from the White House, investors enjoying significant profits and lofty stock prices began to treat the ramifications of the trade war with renewed seriousness.

Art Hogan, chief market strategist at B. Riley Wealth Management, remarked, “Though we’ve encountered bumps along the road since April before, this feels particularly significant. Like a situation that could completely derail things.”

The abrupt changes interrupted a streak of strong market performances; after hitting about 32% growth since the lows in April, the S&P 500 had established more than 30 new all-time records. As of Friday morning, many traders were more worried about a potential bubble fueled by fear of missing out than another sell-off due to tariffs.

However, the end of the week saw them offloading various major winners, showcasing how stark price hikes and high valuations can render assets vulnerable when facing changing circumstances.

Tech stocks faced heavy hits, with the S&P 500 information technology segment plunging 4%, cutting into its extraordinary 45% gain over the past half-year. High-flying chip stocks like Super Micro Computer, Synopsys, and Microchip Technology were among the worst performers in the S&P 500 on Friday.

Wedbush Securities analyst Dan Ives concluded in his note to clients, “This uptick in tensions has created a tension-filled moment for markets with tech stocks under substantial stress.”

The chip industry is currently ground zero in the trade dispute, but it’s not the sole sector at risk. Regional banks also fell, with investors predicting their lack of big trading operations could make them more susceptible to any economic repercussions from the trade stand-off. Such concerns also caused a drop in FedEx shares, which declined by 5.2%, while oil prices reached new lows, dipping below $59 a barrel for the first time since May.

Trump’s threats had a widespread negative impact, driving down stocks in various trade-sensitive industries such as automakers, clothing producers, and consumer health and beauty brands.

Investors are cognizant that the market stability is now more precarious, as prolonged growth has inflated valuations, rendering the largest stocks historically pricey. The prices investors are willing to pay for every dollar of revenue among S&P 500 companies has reached unseen levels.

This summer, interest in ‘meme stocks’ made a comeback like never before, reminiscent of the zero-interest-rate frenzy in 2021—raising flags for many Wall Street professionals. Real estate platform Opendoor Technologies and bitcoin mining developer Cipher Mining have surged impressively without clear alignment to their business models.

There are numerous arguments that the market upturn is underpinned by solid fundamentals. Corporate earnings have been strong and analysts project an impressive 16% earnings growth for S&P 500 companies in the coming year.

While tech stocks and the surge in AI speculation have propelled market Indicators, exuberant growth is also apparent in every other sector. Industry stocks are up 14% for the year, with the financial sector rising by 8%.

Conversely, consumer staple companies—known for their reliable earning performances and generally unfancy recognition during recessions—remain the sole S&P 500 category showcasing losses over the past half-year.

Historically, stock markets have bounced back swiftly following downturns. Current benchmarks may rebound upon seeing bank profits, which are anticipated to be strong when earnings season begins next week.

For the time being, with the trade war lifted back into discussion, investors are weighing whether their hopeful economic scenarios built into stock valuations truly represents the whole picture that lies ahead.

As noted by Sam Stovall, chief investment strategist at CFRA Research, “Bull markets don’t fade away due to age but due to fear, primarily, the fear of recession.”

For inquiries, reach out to Jack Pitcher at jack.pitcher@wsj.com