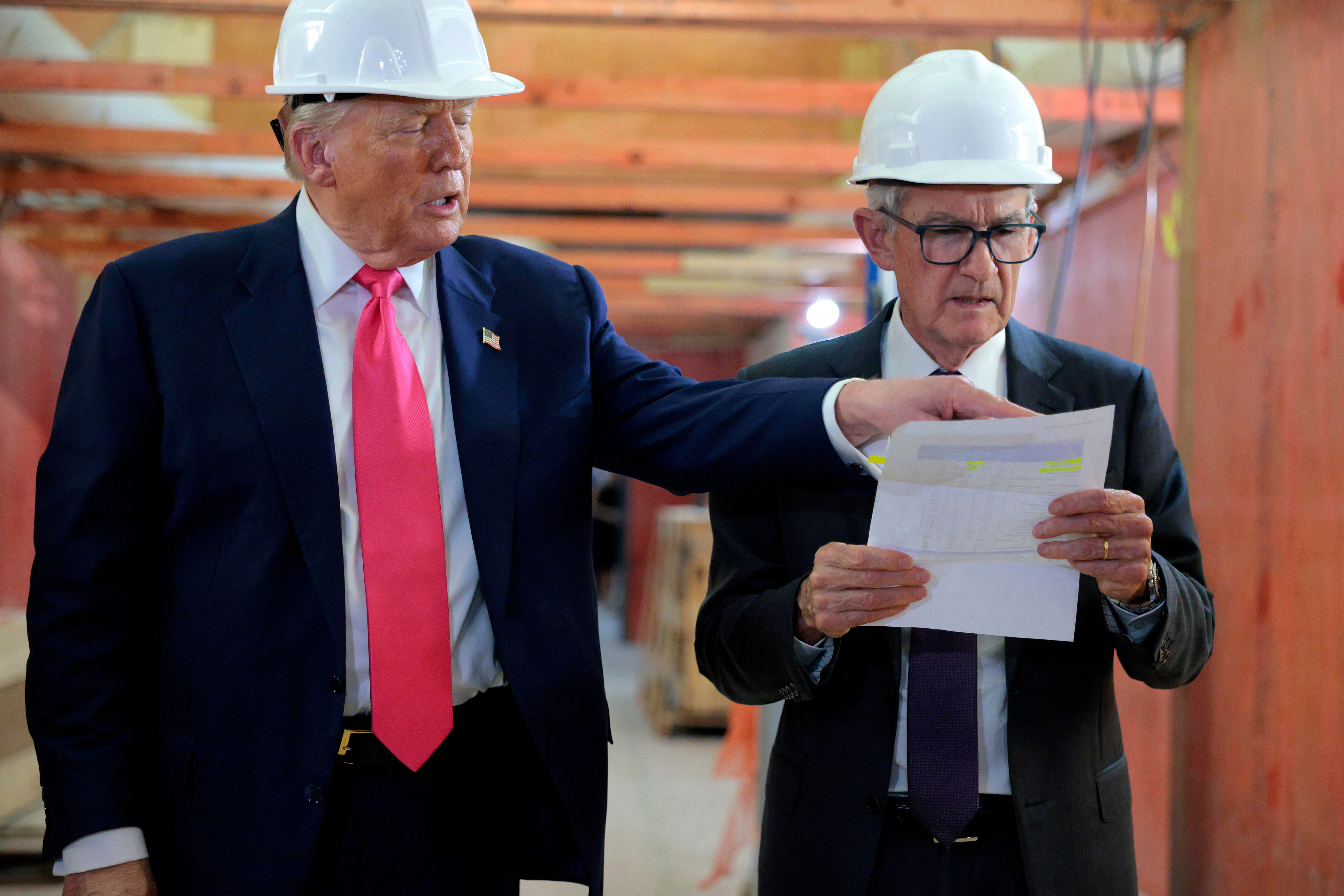

Washington, D.C. — In a surprising turn of events, President Trump and the Federal Reserve Chair, Jerome Powell, found themselves at odds right upon their arrival at the Fed’s headquarters in Washington on Thursday. Their main point of contention? The spiraling costs of a major renovation project affecting two buildings of the reserve.

Just last week, Trump hinted that Powell’s management of this significant undertaking could potentially lead to his dismissal. However, during the tour on Thursday, the President softened his stance, stating he didn’t believe firing Powell was the necessary course of action.

While donning hard hats on-site, the two men engaged in a spirited discussion regarding the project’s escalating budget, which Trump claimed had jumped to an astounding $3.1 billion. Powell, shaking his head, insisted that he’d yet to hear such an estimate from anyone within the Fed. Trump even handed over a document to Powell for review, which prompted further debate.

Powell pointedly commented, “That number comes from you adding on costs related to the Martin building, which was completed five years ago.” To which Trump retorted, “But that building is part of the overall work!”

The conversation revealed both men’s perspectives on the renovation progress and costs. When Trump pressed Powell on whether there anticipated future costs could necessitate further scrutiny, Powell responded confidently that he did not expect any additional overruns, stating the project is slated for completion by 2027.

After wrapping up the tour, Trump deemed the renovation an extravagant setup, yet when he was pressed whether overspending justified Powell’s termination, he diplomatically pointed to the project’s complexity and suggested he hoped to see it through to completion without jumping the gun on any drastic moves.

Expressing a somewhat amicable sentiment towards Powell, Trump mentioned feeling optimistic about their working relationship, but reiterated his unwavering request for interest rates to decline.

When asked why he didn’t simply remove Powell before his term ends in 2026, Trump remarked, “It’s a huge decision, and not one I think is needed at the moment.” He added his belief that Powell would ultimately make the right choices moving forward.

The past several months have seen Trump publicly criticize Powell for holding the short-term rate steady at 4.3% this year, particularly after prior reductions last year. Powell has maintained that the Fed is taking a hawkish stance in response to the economic effects of Trump’s substantial tariffs, suggesting that these could stoke inflation levels.

This cautious approach from the Fed has inadvertently raised Trump’s frustration. The President has consistently called for lowered borrowing costs aimed at not only boosting the economy but also lessening the federal interest obligations.

Initiatives surrounding the Fed’s renovations have seen costs leap from $1.9 billion to around $2.5 billion due in part to inflation and increased material prices in the wake of a spike up in costs during 2021 and 2022.

Last week, when asked if the high renovation expenses could indeed justify letting Powell go, Trump made his stance crystal clear: “I think it is.” He harshly pageantry about the $2.5 billion investment in renovations as being, in his opinion, excessive.

Experts warn that ousting Powell could raise significant concerns surrounding the Federal Reserve’s autonomy—an aspect strongly upheld by seasoned economists and market pro’s alike, hinting that it could shake financial stability if implemented.

In various instances, Trump has openly labeled Powell using terms like “numbskull” and a “stubborn mule”—the latter remark was made during a prior Oval Office gathering with House Republicans, where discussions about whether Trumpseld contemplate Powell’s dismissal were rumored to have taken center stage.

Comprehensive Renovation Projects

Plans for the complete refurbishment of the Fed’s headquarters were made official back in 2017, moving through a round of approvals that included key commissions consisting of Trump appointees. One such commission advocated for using more marble for the extensions on the buildings set for renovations, aiming to offset what some aesthetics deemed problematic in design.

Furthermore, according to Fed staffers, material prices influenced by tariffs and increasing expense factors have not helped the renovation budget. Since Trump rolled out tariffs back in 2018—including 25% on steel and 10% on aluminum—prices for raw materials have surged. In fact, steel costs have jumped approximately 60% since early project proposals.

The complexity involved with renovating historic buildings has constrained the budget as well; Fed staff privately confirmed that constructing new offices from the ground up would’ve been less costly for a new site.