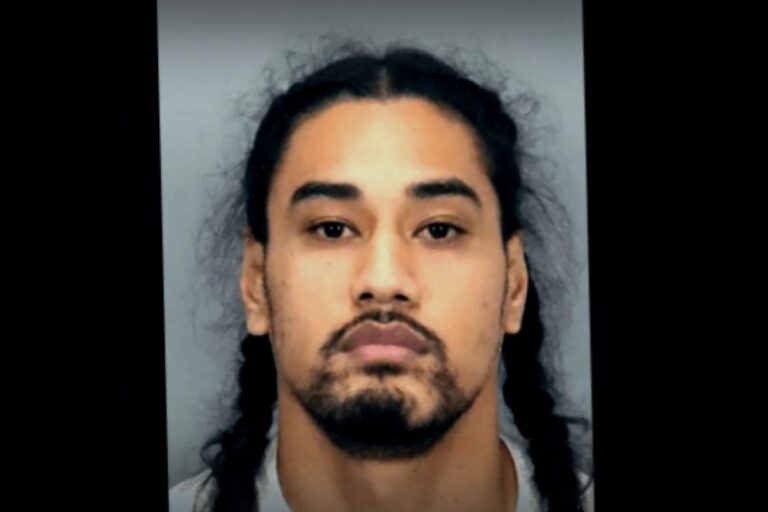

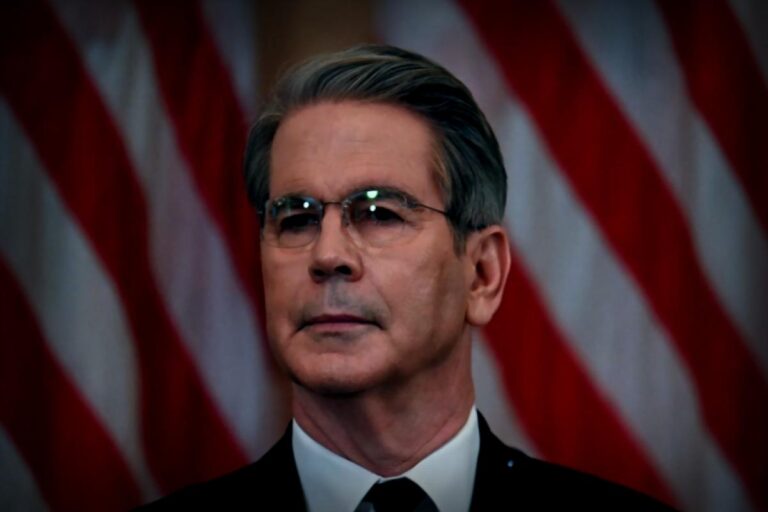

Scott Bessent, the Treasury Secretary, has some exciting news for working Americans: brace yourselves for pretty substantial tax refunds expected next year, likely ranging from $1,000 to $2,000 for each household!

This boost in refunds is set to be a direct result of tax cuts included in President Donald Trump’s flamboyantly named legislation, the One Big Beautiful Bill Act.

We’ve reached out to the Treasury Department for their take on this matter, just in case they want to join the conversation.

Why Is This So Important?

Bessent’s announcement about refunds could be a game changer for many households. This means extra cash in hand early next year, marking a crucial upside from Trump’s tax reforms that aim to put more money where it matters—right in the pockets of working citizens!

Here’s What You Need to Know

The Treasury Secretary confirmed that these refunds will hit the first quarter of 2026. He shared with a Pennsylvania reporter, “I think we’re looking at $100-$150 billion in total refunds that could mean between $1,000 to $2,000 per household.”

Bessent pointed out elements within the One Big Beautiful Bill Act passed in July, highlighting features like the auto-deductibility policy and the abolishment of taxes on tips, overtime, or Social Security.

What’s most interesting? Many working Americans haven’t adjusted their tax withholdings just yet, meaning they’ll likely see some extra cash coming back in the form of those refunds.

Once these refunds roll in, Americans are anticipated to tweak their withholding rates, which means they’ll pay less tax each pay period. And trust me, that’s bound to lead to genuine increases in take-home pay!

Kevin Hassett, Director of the White House National Economic Council, echoed this sentiment during an interview with CNBC on Monday. He suggested that the average person could see an added $1,600 to $2,000 next year, primarily through tax refunds.

What You Should Know From Bessent and Hassett

According to Treasurer Secretary Bessent: “Since the bill was greenlit back in July and working Americans have kept their tax withholding unchanged, they should expect to receive hefty refunds in early 2026. This could trigger anywhere between $100-$150 billion in refunds, with each household potentially receiving $1,000 to $2,000. After people adjust their withholding, they can enjoy a substantial bump in their paychecks.”

Meanwhile, Kevin Hassett added: “Looking into next year, typical workers not taxed on tipping or overtime will likely come out ahead by about $1,600 to $2,000, mainly through those tax refunds at the start of the year.”

What’s Next?

Mark your calendars for early 2026, because that’s when Bessent suggests these refunds will start rolling out!