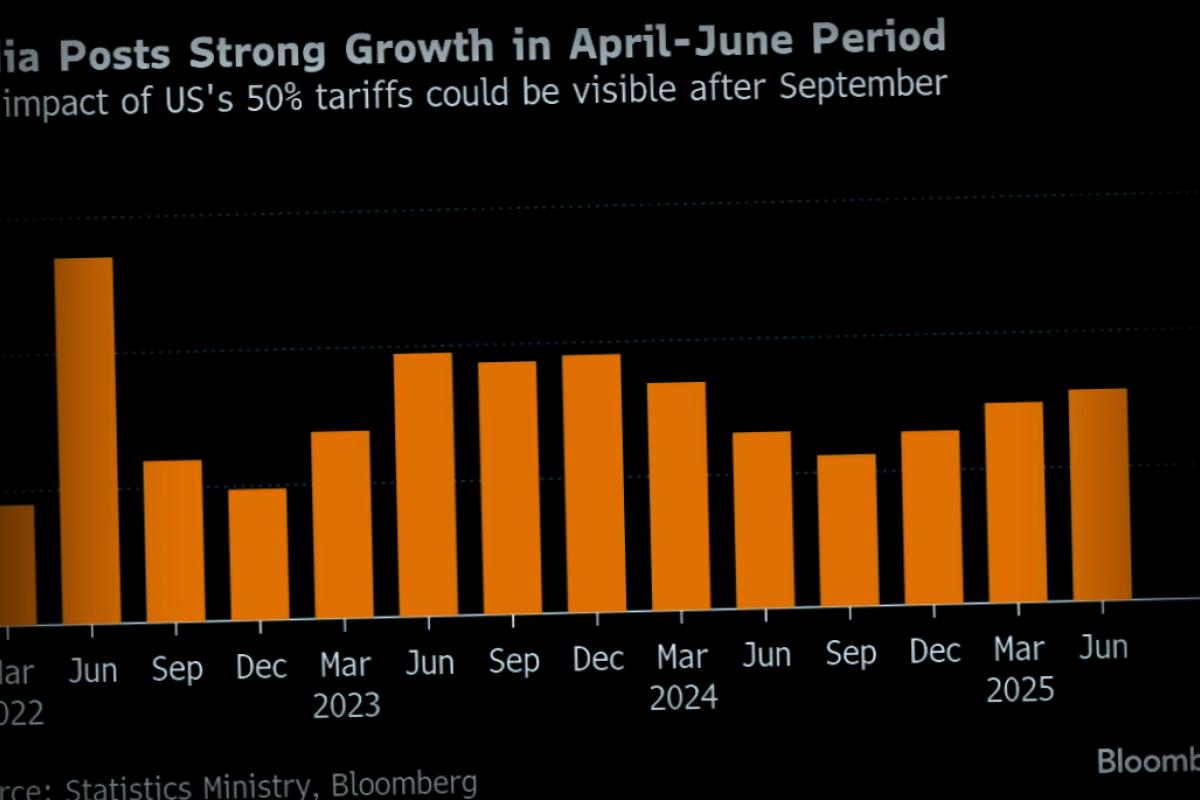

India’s economic surprise

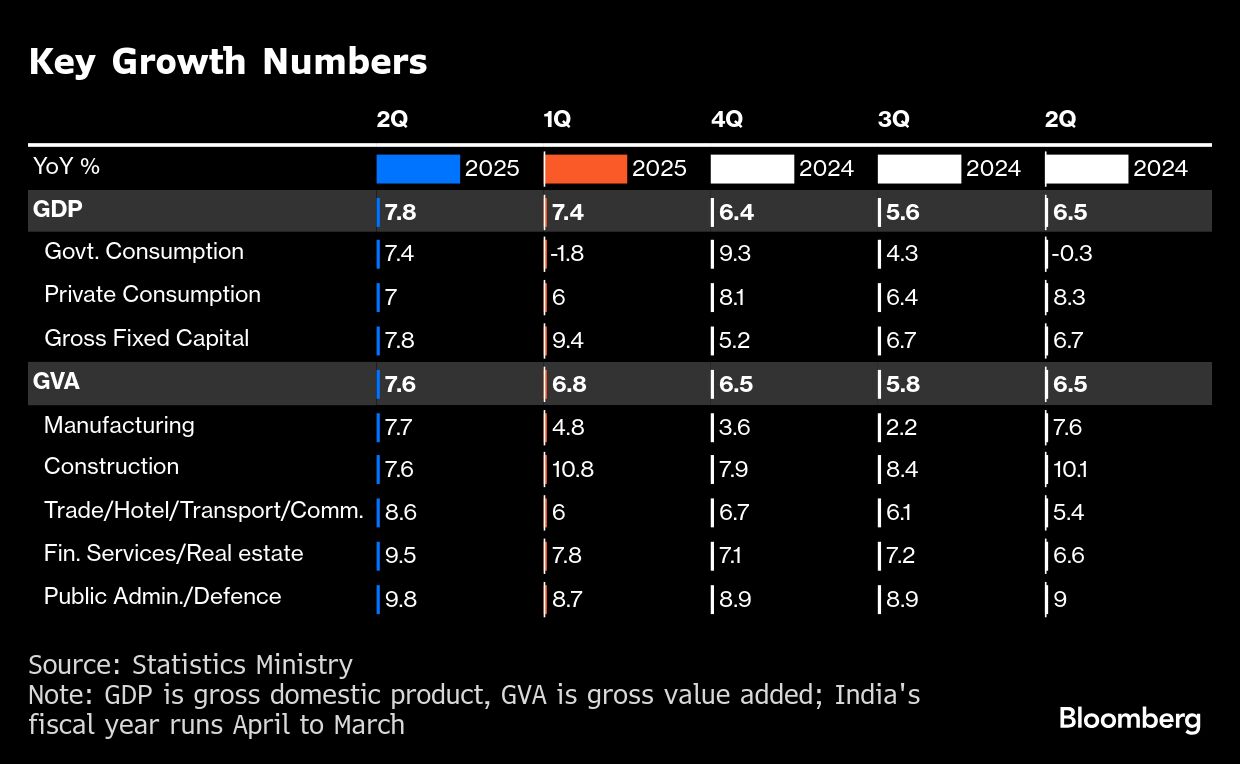

According to Bloomberg, India’s economy has made a surprising jump, growing by 7.8% in the last quarter. This rate is the fastest it’s seen in over a year and blew past what economists predicted in a recent survey. The growth has been fueled by gains in manufacturing and construction, along with increased government spending and service sector activity.

V. Anantha Nageswaran, who is India’s Chief Economic Adviser, spoke at a press conference about these quarterly figures. He maintained that the government still aims for an annual growth forecast of between 6.3% and 6.8%, despite the looming threat of Trump’s tariffs. He pointed out that, if the tariff situation drags on, it could pose challenges.

Impact of Tariffs

With the US being India’s largest export market, these tariffs could create real challenges for industries like textiles and footwear, which are capitals for employment. Economists from Citigroup predict that these tariffs may slice India’s annual growth by as much as 0.8 percentage points.

Economist Madhavi Arora from Emkay Global Financial Services explained that the proposed tariffs will start to affect exports soon, which could create a ripple effect impacting jobs, wages, and consumer spending. This could lead to less private investment and hinder overall economic growth.

As worries about the tariffs took hold, India’s rupee fell to an all-time low of 88.21 against the dollar, making the currency the worst performer in Asia for the year. The bond yields in India rose by as much as 11 basis points following the GDP data, continuing a trend of fluctuating activity in the local debt market.

Government Responses

In response to these tariff challenges, Prime Minister Narendra Modi’s government is taking steps to stimulate private spending, which accounts for about 60% of the economy. Modi recently announced a tax reduction set to commence in October, aimed at potentially increasing spending and lowering prices. IDFC First Bank predicts that these tax cuts could boost nominal GDP growth by 0.6 percentage points over the next year.

According to Gaurav Kapur from IndusInd Bank, combined monetary loosening, lower inflation, robust services activity, and proposed GST shifts should help offset some external pressures brought on by the tariffs, with the economy likely holding a 6.5% growth rate for the entire year.

Looking Ahead

This data also serves to emphasize the approach to monetary policy. While a few analysts believe the Reserve Bank of India will take steps to assist the economy amidst rising tariffs, others think that this growth spurt may deter rate cuts for some time. The RBI has already slashed rates by 100 basis points this year but kept them steady during its most recent meeting.

Aditi Nayar, an economist with ICRA, commented that the recent GDP growth figures have reduced expectations that the tariff-related issues will lead to any monetary easing in the upcoming policy review.

–Thanks to support from Shinjini Datta, Ravil Shirodkar, and Siddhartha Singh.