After the news that U.S. inflation remained stable in July, White House press secretary Karoline Leavitt issued a statement pointing out convincing evidence regarding price shifts. The increase in costs for specific imports was balanced by reductions in gasoline and grocery expenses.

White House Reaction to Inflation Data

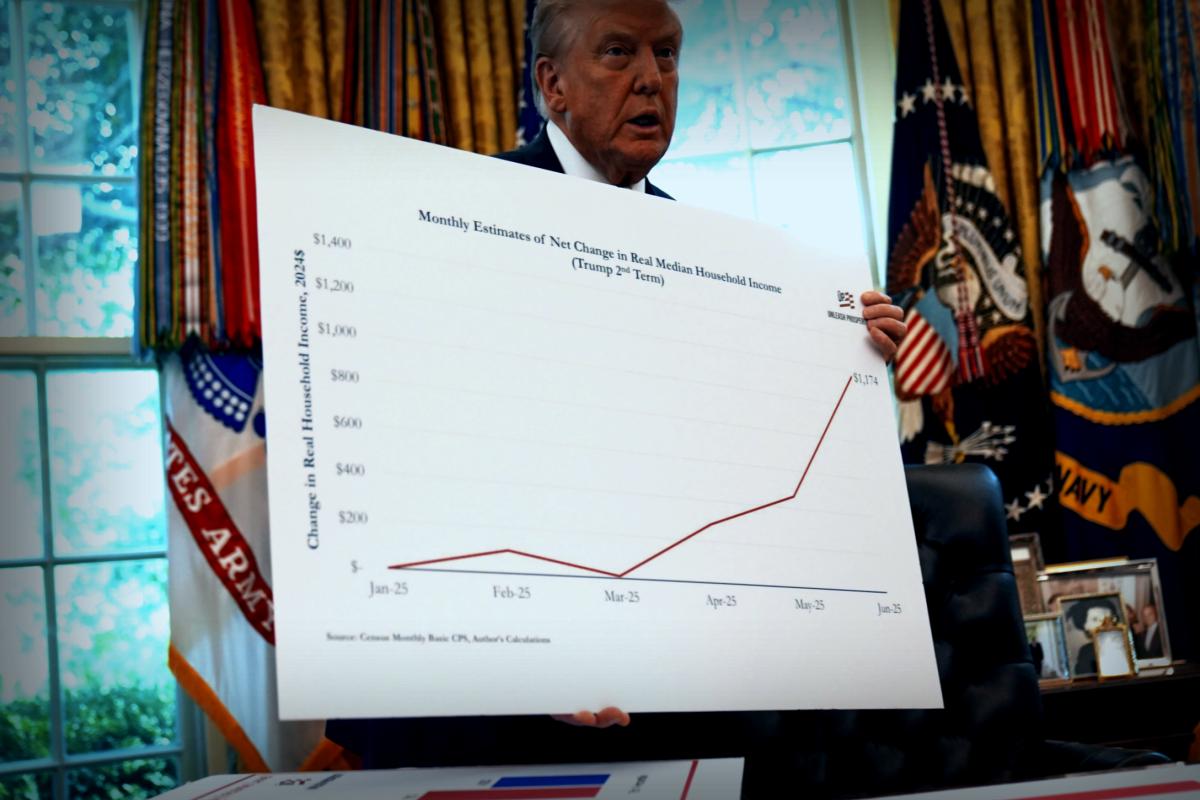

In her press release, Leavitt mentioned, “Today’s CPI report proves again that inflation has surpassed market predictions and maintains its stability, highlighting President Trump’s dedication to reducing expenses for American families and business owners. The data contradicts the pessimism of the skeptics—President Trump’s tariffs are generating billions, small business confidence is reaching a five-month high, and real wages are on the rise. Americans are rightly supporting President Trump’s America First strategy that aims to reinvigorate our economy.”

Understanding the CPI Report: Why Some Prices Are Up

Overall inflation remains at 2.7% year-on-year, although core inflation—calculating by excluding the fluctuating food and energy sectors—saw a climb to 3.1%, up from 2.9% the previous month. Experts express that this increase indicates ongoing price pressures bubbling just under the surface, even with consumers experiencing temporary breaks at gas stations and grocery stores.

The slide in fuel prices by 2.2% since June and a slight 0.1% dip in food prices played a crucial role in maintaining overall inflation numbers. However, the tariffs enacted by President Donald Trump are elevating prices on certain imported items such as shoes and furniture, with early signs of affected goods pricing. While businesses may be temporarily absorbing these cost rises, economists caution that further price hikes or even strategies like “shrinkflation”—reducing product size while retaining the same price—might be on the horizon.

The Federal Reserve is confronted with decisions due to these statistics. Lower rates in September would be logical following the slower hiring trends and decreasing headline inflation but rising core prices reflect underlying inflation dynamics that persist. Chair Jerome Powell lauds caution in their approach, especially while tariffs continue influencing supply chains, weighing between permitting the market to stagnate further or risking economic health by acting too soon.

Expert Opinions

Brian Bethune, an economist associated with Boston College, remarked that U.S. tariffs—determined by the amount of duties collected from imports—are currently at 10%>, a peak not seen in decades and likely to persist.

According to Bethune, “These rising costs will inevitably affect consumers in some way or another.” He flagged that companies might resort to “shrinkflation,” where product quantities diminish while prices remain unchanged.

On Truth Social, President Trump shared early Tuesday, “Jerome ‘Too Late’ Powell needs to decrease the interest rate now. Steve ‘Manouychin’ gave me a headache with his decisions during his tenure. The overflow of disastrous outcomes from his tardiness can’t be taken lightly. Thankfully, the economy is so robust that we can disregard Powell’s approach. I’m also debating moving forward with a major lawsuit related to Powell’s management failures regarding the construction of Federal Buildings—spending three billion on ventures that should’ve only cost fifty million is absolutely unacceptable!”

Release Timing of CPI Reports

The U.S. Bureau of Labor Statistics makes the CPI reports public on a monthly basis, generally released in the month’s middle. This data reflects price modifications from the previous month, allowing economists, policymakers, and everyone else an updated perspective on inflation trends. Just to reference, July’s CPI report, highlighting the shifts in fuel, grocery, and core prices, was made public in mid-August.

Update: 8/12/25, 12:29 p.m. ET: This information was recently amended to incorporate fresh insights.