Earlier this year, traders on Wall Street developed a catchy phrase: TACO — Trump always chickens out — to highlight President Trump’s up-and-down approach to tariffs. Analysts noted that Trump often pushed for hefty import taxes but then backed down whenever the markets took a hit.

Fast forward to today, and it looks like Trump is challenging the markets directly.

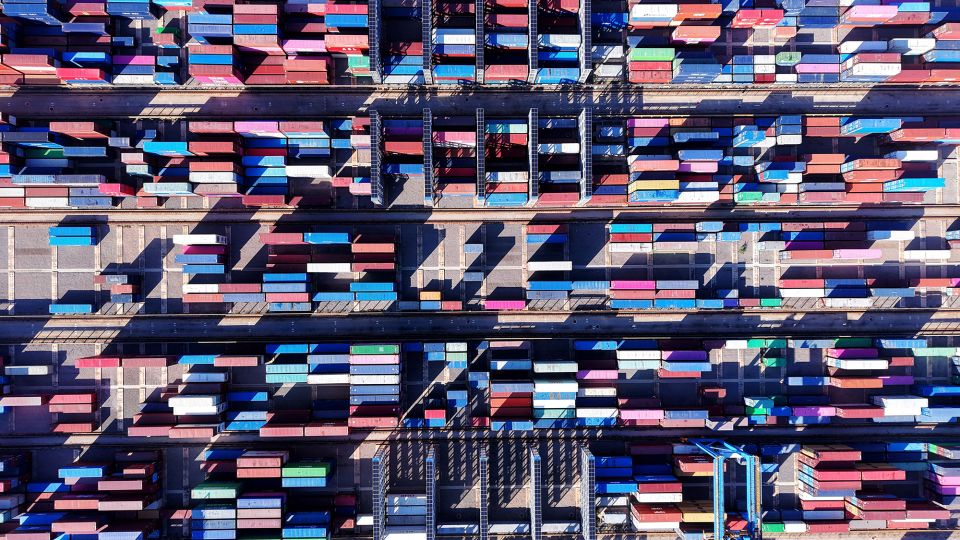

A new wave of tariffs kicked in on Thursday, bringing the average tax on imports to the highest levels seen since the 1930s. Surprisingly, Trump is banking on the idea that the market can handle this news and will recover without much fuss, and so far, this theory seems to be holding up.

For the week, stocks actually finished strong, with the Nasdaq hitting an all-time high on Friday, and the S&P 500 enjoying its best week in over a month.

This is a stark contrast to early April when Trump’s informal “Liberation Day” tariffs sent stock values crashing.

However, economists warn that it may take weeks or even months to truly gauge the effects of these tariffs. Therefore, it’s premature to declare a straightforward victory just yet.

As Ethan Harris, former global economics chief at Bank of America, pointed out, “He’s managing to implement strong tariffs without rattling the stock market.” He added that some might even view this as a success for those in favor of tariffs.

However, it’s important to note that Wall Street still has a lot of cards in its hand, and the game is far from over.

Trump’s Persistent Strategy

Over recent months, investors have caught onto the so-called TACO trade.

A better way to frame this phenomenon, according to Harris, is with the phrase: “Trump always tries again.” With current tariff levels being almost similar to what he attempted to enforce on April 2, traders are understandably concerned.

While the stock market is staying near record highs, Harris emphasized that tariffs could potentially harm the economy in a very real way, leaving it uncertain how long investors can maintain their current relaxed outlook.

Impact of Tariff Exemptions

Kurt Reiman, who is the chief of fixed income at UBS, notes that exemptions from certain tariffs have helped to cushion the impact overall. For instance, some imports from India and semiconductors for Apple (AAPL) are excluded due to the company’s commitment to bolster U.S. production. Thanks to this, Apple’s stock witnessed a impressive 13% surge last week, marking its best week since 2020.

Reiman stated, “The tariff barriers the government is erecting have numerous loopholes due to various product exemptions and delays in implementation, softening the overall impact on investors.”

AI Boom Overshadowing Tariff Concerns

In addition to tariff debates, excitement surrounding the AI boom in the U.S. is adding to market momentum, diverting attention from tariffs.

While there have been fears related to trade policies, significant earnings reports from tech giants like Nvidia (NVDA) and Meta (META) have positively influenced the market.

Fortunately, other trading partners have mostly refrained from retaliating, helping to avert a potential global trade war that could have severe consequences for the U.S. economy, according to David Doyle from Macquarie.

Robert Armstrong from the Financial Times — the journalist who popularized the term TACO — told CNN’s Richard Quest that, “What’s really remarkable is how little pressure Trump has had to back down from.”

Wall Street’s fear gauge, the CBOE Volatility index, briefly exceeded 50 points in early April — a level unseen since significant crises hit in 2008 and during the Covid pandemic. Nowadays, though, the VIX has dropped and settled around 20 points, indicating mild volatility.

Trust in the ‘Trump Put’

Most investors continue to place their beliefs in the “Trump put.” This exists on the assumption that if the markets take a nosedive, Trump will adjust his strategies. Analysts argue this is different from just backing down as it implies that Trump might yield just enough to pacify investors and then push ahead with tariffs when he can.

“He consistently tries again until the market retaliates against his policies,” Harris remarked, referring to an old idea about the ‘Trump put,’ which remains relevant in conversations about the ongoing trade war.

Stocks vs. Economic Reality

While Trump is pushing forward with his tariffs, it might be too hasty to claim a victory just yet. Investors are eagerly waiting for upcoming data on inflation and job markets to better understand how tariffs are impacting the economy.

“As an investor, it’s easy to convince yourself that tariffs aren’t a concern, but for a firm planning its business, ignoring the tariffs isn’t feasible,” commented Harris. He made a point to illustrate that the stock market and the economy function differently.

Arun Sai, senior strategist at Pictet Asset Management, pointed out that investors are taking a leap of faith, believing both in the strength of the U.S. economy and that the adverse effects of tariffs won’t be as damaging as feared.

Yet, overall, Sai believes that markets are potentially being a bit too complacent. He plans to closely watch the next two inflation reports leading up to the Federal Reserve’s policy meeting this September in hopes of catching the early signs of damage caused by tariffs.

“We definitely aren’t out of the woods yet,” Sai concluded. “We seem to be banking on no negative developments, but a pivotal moment looms on the horizon.”

For further updates and news, you can register on CNN.com