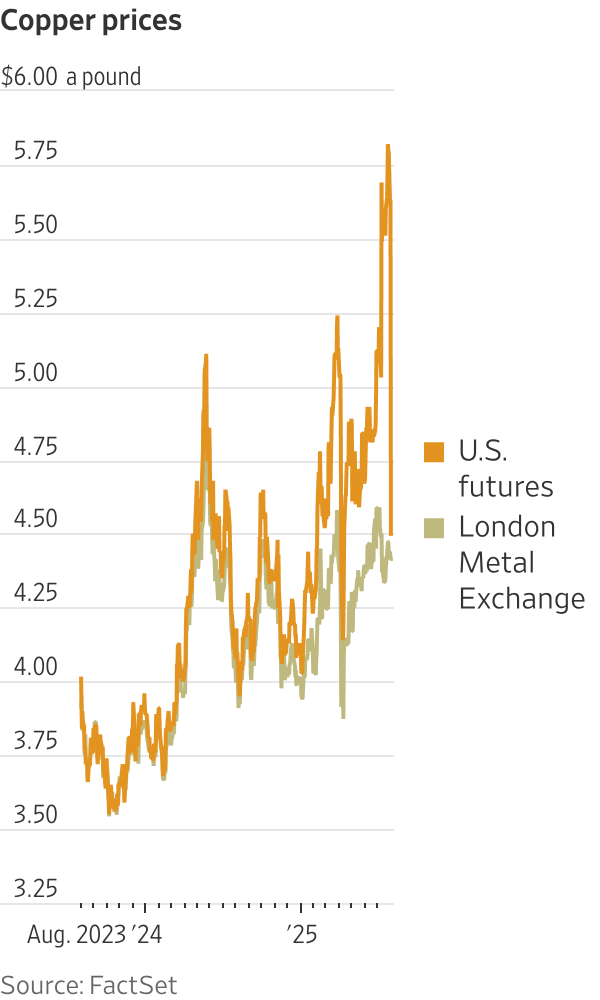

On Wednesday, the copper market took a nosedive as U.S. copper futures tumbled approximately 20% after President Trump announced a hefty 50% tax on copper products, leaving the raw material untouched.

This dramatic change highlights the chaos that Trump’s fluctuating trade policies can create in financial markets. If this steep decline holds through Thursday’s trading, it could end up being the largest single-day drop for copper since 1968, surpassing the 12% plunge seen after the infamous Black Monday crash in 1987.

Earlier this month, U.S. copper prices soared to record highs, well above global standards, when Trump hinted at imposing a 50% import duty on copper, which plays a crucial role in manufacturing electronics, vehicles, and infrastructure, such as water pipes and electrical wires.

In anticipation of the tariff, traders and businesses scrambled to import copper, flooding storage facilities in cities like Baltimore, New Orleans, and Detroit.

However, just before the new tax was scheduled to take effect on August 1, the White House changed direction, deciding against imposing tariffs on less processed copper forms, including concentrates and cathodes. Instead, they focused the levy solely on products like wiring, tubing, and sheeting.

The 50% tax will also affect the copper content in various products, such as pipe fittings and electrical connectors, although it won’t add to existing automobile levies, according to a fact sheet released by the White House. While this tariff aims to protect domestic makers of electronics and plumbing fixtures, it may not benefit miners or smelters looking to boost local production.

Shares in Freeport-McMoRan, which is the largest copper producer in the U.S., dropped by 9.5%, while stocks of Ivanhoe Electric, set to start construction on a major Arizona mine next year, decreased by 17%.

Traders were hoping for exemptions, particularly from Chile, as it provides over 70% of U.S. copper supply. Even though U.S. prices had climbed to new highs, they never hit a premium of 50% over global rates determined in London exchanges.

Now, in an unexpected turn, U.S. copper prices have dropped back to where they were before Trump initially announced plans for a 50% tariff in July, aligning once more with global prices at around $4.50 per pound.

Initially, Trump’s threat of such a high tariff sparked excitement in the mining industry, as it filled many with hope that regulatory barriers on new mining and smelting projects would also be lifted. However, there were concerns about inflating copper prices based on impulsive comments.

As Bernstein analyst Bob Brackett noted on July 9, Trump has previously announced significant tariffs without follow-through. Given that the U.S. imports over half of its copper and has only two functioning smelters to process copper concentrate, developing new facilities could cost upwards of $5 billion and take longer than Trump’s remaining term, all while operating at typically low profit margins.

Brackett concluded, “The tariff gives no real incentive for sensible economic action; it just increases costs for U.S. manufacturers.”

Feel free to reach out to Ryan Dezember at ryan.dezember@wsj.com