Rivian Automotive ($RIVN) grabbed the spotlight during its AI & Autonomy Day event, where it showcased a lot of exciting tech. They rolled out their own self-driving chip, a beefed-up third-generation computer system, and something they call the Rivian Assistant AI. Plus, they unveiled a new feature d the Large Driving Model , which aims to enable hands-free driving across a staggering 3.5 million miles of North American roads. To take advantage of this feature, drivers will need to subscribe to the paid Autonomy+, and Rivian also teased future upgrades, hinting at the addition of LiDAR and radar technologies. Ultimately, they aim to achieve Level 4 autonomy, which sets the stage for robotaxi services.

While it seems investors are riding high (notable 16% boost in shares at the moment), analysts at Morgan Stanley (MS) are taking a more reserved stance. Five-star analyst Andrew Percoco pointed out that Rivian is equipping itself for future competition in the auto industry. However, he’s raised his concerns about potential risks, specifically low demand. This scarcity might hinder them from collecting the driving data necessary to refine their self-driving tech and move towards profitability. Consequently, Morgan Stanley is advising a Sell rating, targeting a price of $12 per share.

On a different note, Wells Fargo (WFC) has adopted a more balanced view with a Hold rating. Analyst Colin Langan noted the recent stock buzz is fueled by optimism surrounding Rivian’s innovative tech, appealing designs, and strong partnerships. Yet, he emphasized that the company is treading on thin ice and can’t afford many slip-ups. Plus, without much experience in automotive manufacturing and sales, Rivian needs to prove that it can draw in customers without laying out excessive marketing spend for lasting success.

RIVN Stock: Buy or Sell?

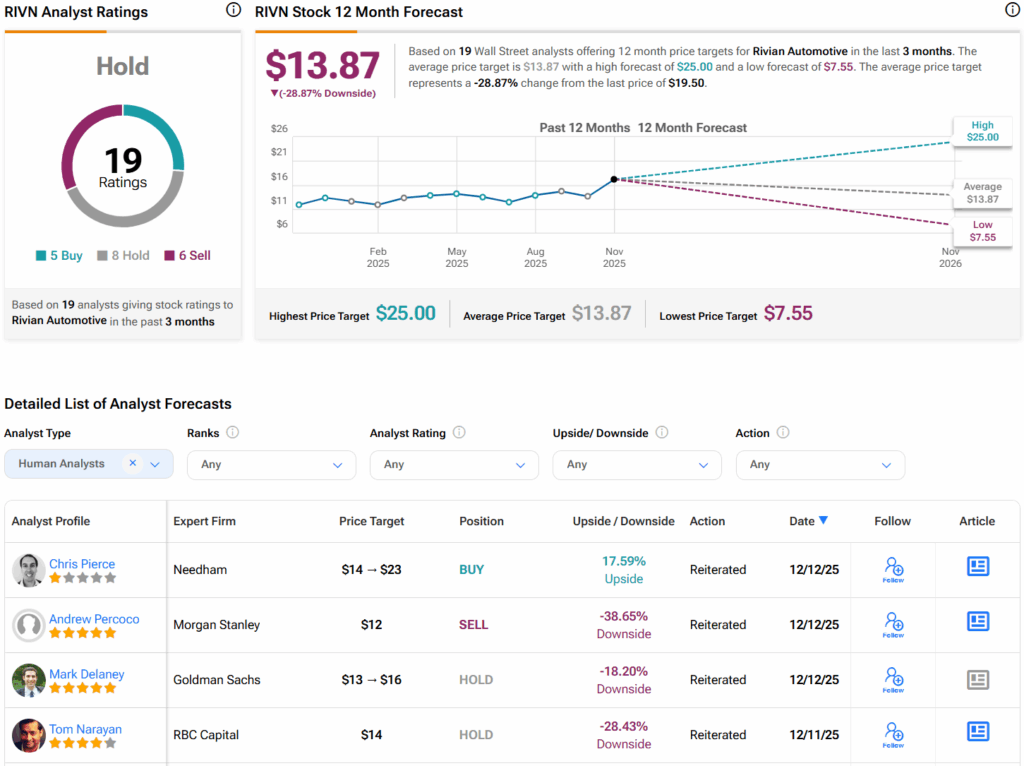

Looking over Wall Street sentiment, analysts have given RIVN a Hold consensus rating. This is based on five Buy ratings, eight Holds, and six Sells assigned over the last three months. According to recent data, the average target price for RIVN sits at $13.87 per share, indicating a potential downside of 28.9% from current levels.

See more RIVN analyst ratings

Disclaimer & DisclosureReport an Issue