China is pushing for independence in making semiconductors and has now instructed state-funded data centers to exclusively use AI chips manufactured within the country. This guideline seems to extend silently to private firms as well, resulting in significant changes for tech giants like ByteDance, the organization behind TikTok. They’ve been told to stop using Nvidia (NVDA) chips in their operations.

Historically, about 13% of Nvidia’s earnings came from China, which sounds like a lot but it’s falling. With ByteDance being Nvidia’s biggest customer in China, that source of revenue is taking a hit, which isn’t exactly good news for Nvidia investors. It may feel rough, but many expected some impact.

On the plus side, Nvidia continues to have a strong global market share. Even though the restrictions in China are tough, the company’s pathways and strategy are mostly on track. And don’t forget, Advanced Micro Devices (AMD) recently mentioned they are not counting on any China revenue for their 2025 predictions either. Similar warnings have come from other firms like ASML and Synopsys, who aren’t relying on Chinese sales in their forecasts.

This broader issue isn’t unique to Nvidia alone; it’s clear that this trend is industry-wide, suggesting any risks linked to China may have already been included in the stock prices. Thus, individuals shouldn’t panic about this specific news.

Nvidia’s Stock Landscape

Nvidia specializes in the design and production of processors along with related software, most well-known for their GPUs originally favored by gamers but now crucial for AI development. The firm’s base is in Santa Clara, California.

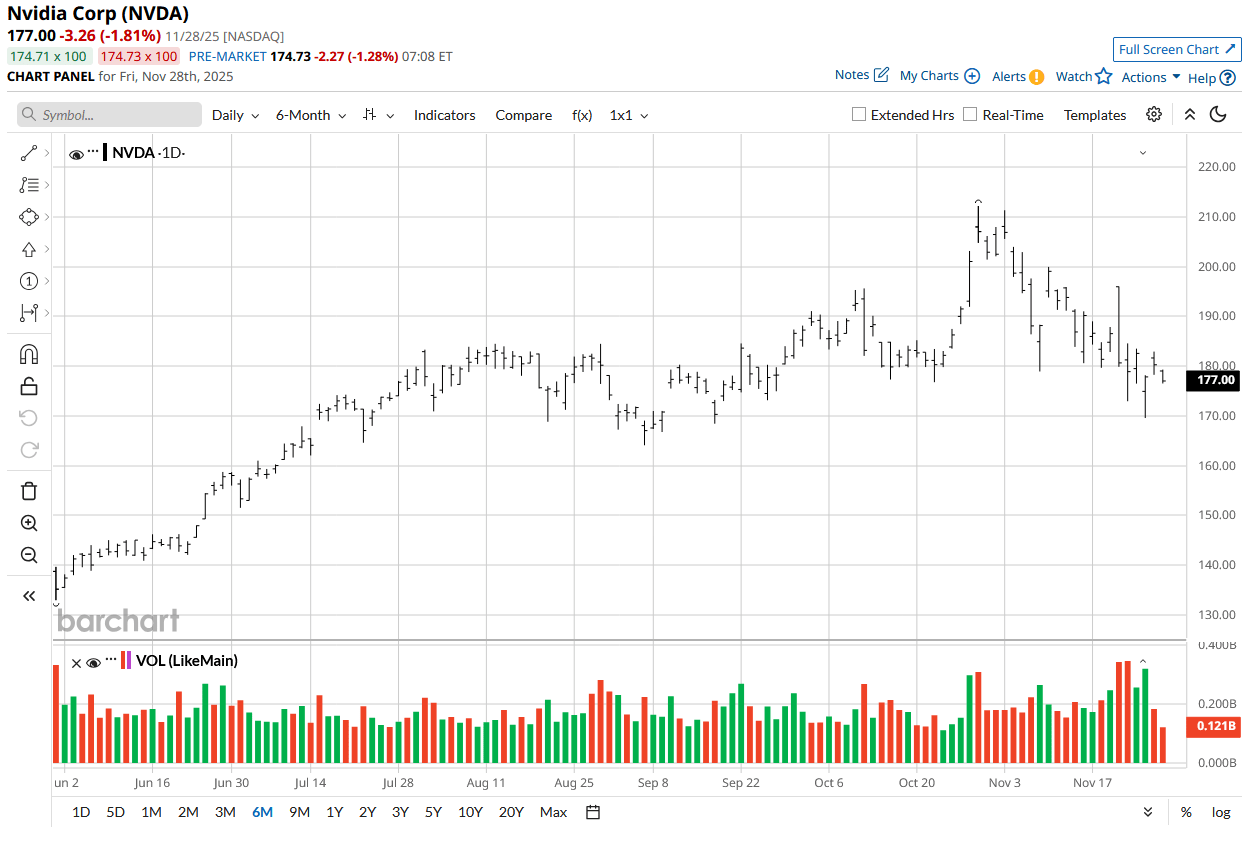

The stock has performing well, boasting a 27.66% return over the last year compared to the S&P 500 Index ($SPX), despite a dip after earnings announcements.

This quick turn in market expectations has led to Nvidia’s valuation dropping, making it a potentially attractive option for new investors. Previously, Nvidia has maintained high market valuations and delivered solid results. But the recent dip has brought valuations lower than previous five-year averages. For instance, the current forward P/E stands at 38.54x, 33% below the five-year benchmark of 58.04x. This implies the market is adjusting to forecasts of slower growth.

Nonetheless, these hurdles do not undermine Nvidia’s long-term prospects, which still present a valid investment opportunity at the current price. Forecasts indicate an impressive growth rate in earnings per share (EPS) exceeding 50% for both 2026 and 2027, making the current ratios even more appealing.

Nvidia’s Q3 Earnings Outperform Expectations

Nvidia’s latest Q3 earnings report, released on November 19, showed better-than-expected numbers, pulling in $57.01 billion compared to a projected $54.92 billion and an EPS of $1.30 versus the anticipated $1.25.

The upcoming quarter may mirror this strong performance, with management predicting revenues of $65 billion against consensus estimates of $61.66 billion. There are valid reasons for this anticipated growth, and investors should pay attention, especially with the backdrop of the China bans. CEO Jensen Huang emphasized during the earnings call that Nvidia’s role extends beyond just aiding AI model training, instead playing a critical role during deployment and inference stages. This is significant as concerns mount over a slowdown post-training.

Nvidia’s CFO, Colette Kress, reiterated that the firm is not including any revenue from data centers in China, having anticipated the impacts of a decline well in advance. On a more promising note, Huang confirmed that Nvidia intends to keep on with stock buybacks while continuing to plow back into R&D efforts.

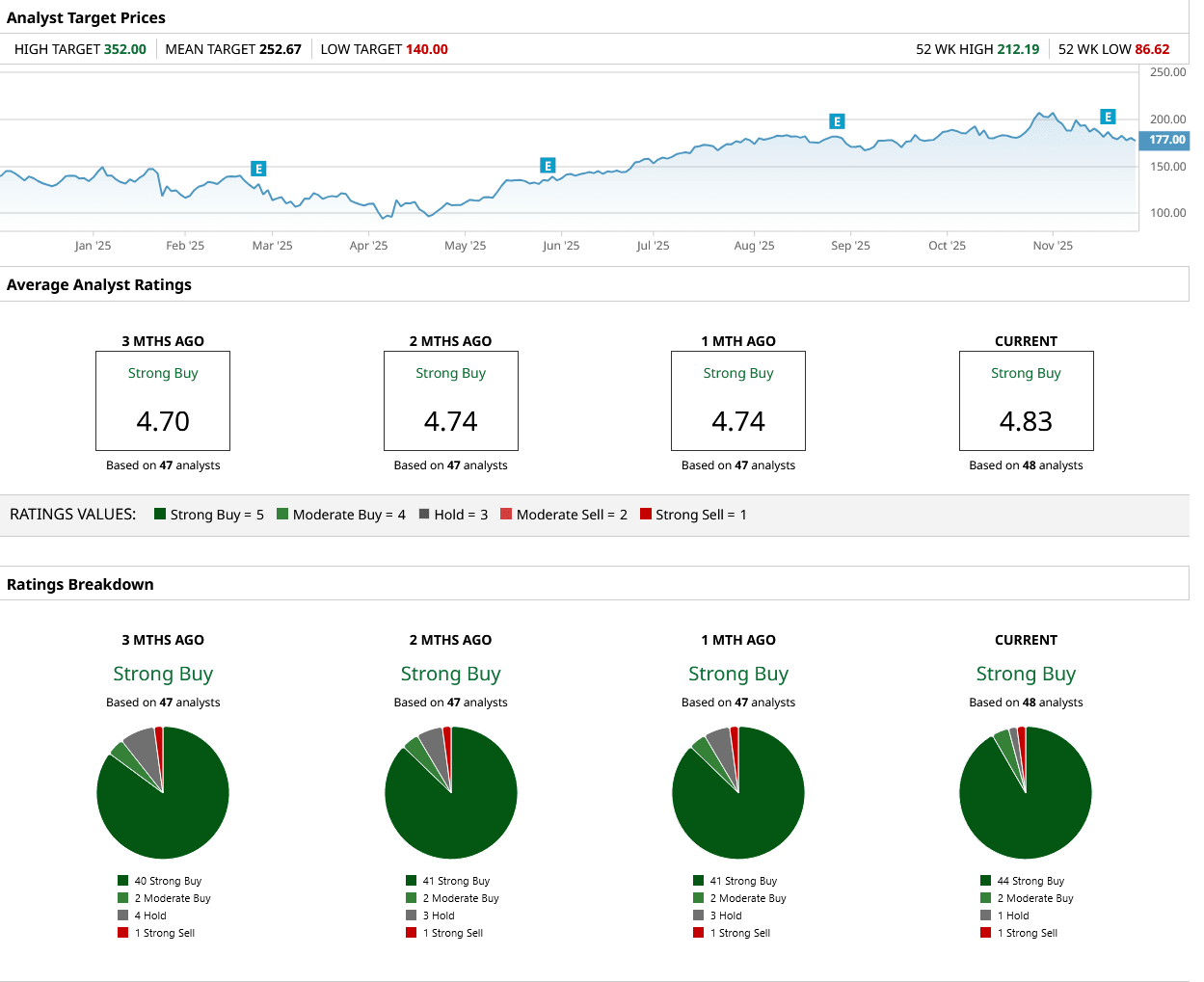

What Analysts Think About Nvidia’s Future

Wall Street analysts are feeling pretty bullish about Nvidia, with 48 giving it a “Strong Buy” rating. Out of those, 44 hold the designation, showcasing robust market confidence in the firm. Currently valued about 16.5% lower than its 52-week peak and below its traditional averages, there’s less reason for concern regarding the Chinese restrictions.

On the publication date, Jabran Kundi did not possess any direct or indirect investments in the mentioned securities. All facts and data presented here are purely for informational purposes. For further details, please check Barchart’s Disclosure Policy here.