Artificial intelligence is shaking up the fintech world right now, revealing new possibilities for companies that are smart about using data, automation, and predictive models. Two key players in this space are Intuit Inc. and Upstart Holdings, both riding the AI wave but with totally different agendas.

Intuit is fully harnessing its suite of products—like QuickBooks and TurboTax—to create an all-encompassing platform for users, small businesses, and pros. On the flip side, Upstart is disrupting the world of consumer lending with its innovative approach to credit assessments, moving into auto loans and home equity lines of credit.

Both companies are on fast tracks for growth, but their strategies diverge significantly. Intuit aims for broad diversification across various financial services, while Upstart’s game plan is all about throwing a wrench into traditional credit systems. So, which one should you snag for your investment portfolio? Let’s break down the pros and cons of both!

Why Go With Intuit?

Intuit is banking on a large-scale and integrated AI approach. The company shared an impressive revenue growth of 16% for fiscal 2025, thanks to their significant years-long investments in AI and data services. For the upcoming fiscal year, they expect solid growth between 12% to 13%, which inspires confidence in a steady upward trend.

They’re merging their tools into a comprehensive financial operating system that’s picking up steam, especially with complex mid-market customers, a sector worth a staggering $89 billion. Recent product updates have rolled out AI-powered tools that streamline accounting and payments, reducing the need for manual work by as much as 60%!

On the consumer front, TurboTax Live saw a remarkable 47% increase in user adoption in 2025, signifying a big shift in how tax prep is now done—lessening the strain of manual tasks. Meanwhile, Credit Karma, which grew 32% last fiscal year, continues to bolster its integration into the Intuit ecosystem, keeping users engaged year-round.

However, things aren’t all smooth sailing. Intuit’s success heavily relies on the wellbeing of small businesses and credit conditions, coupled with tax dynamics. A dip in consumer spending could cause a hiccup in growth. Yet, by aggregatingcustomer data and focusing on tech investments, Intuit aims to become a go-to financial hub. With its dependable revenue stream and solid reputation, its focus on AI espouses resilience and consistent expansion.

Why Root for Upstart?

Upstart is coming on strong with its lofty aspirations of transforming into the ultimate destination for credit—targeting the entirety of the American customer base with top-notch loan products. Its advanced AI models, especially one d “Model 22,” are making waves by improving credit assessment accuracy and efficiency in acquiring borrowers. Unlike traditional scoring systems, Upstart’s neural-network model leverages a vast dataset drawn from over 91 million repayment behaviors.

They’re not stopping at personal loans either. Upstart is rapidly expanding into segments like auto and retail financing, with dealerships adopting their systems to facilitate smoother transactions. You can also expect Upstart to huddle into the HELOC game by compressing what used to be a month-long validation process down to mere minutes. Plus, the rise of small-dollar loans is helping broaden their market reach.

Notably, Upstart is extending their tech prowess beyond initial approvals into servicing loans. By applying machine learning, they’ve slashed delinquency rates by as much as 32%, boosting loan performance while improving customer interactions through AI. With strong backing from various financial institutions, Upstart is positioned to keep scaling these innovations with minimal reliance on their capital.

By combining advanced AI technologies with a growing range of products, Upstart is positioned to revolutionize the lending experience.

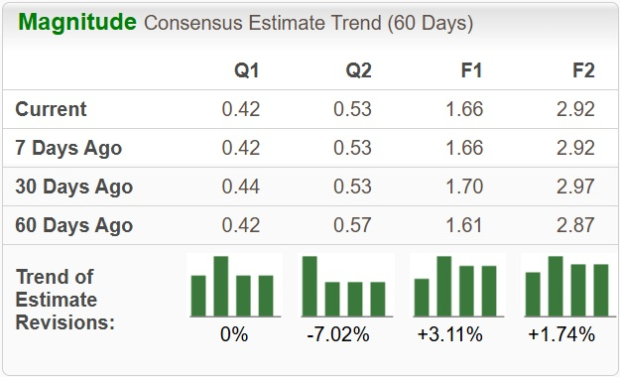

Zacks Estimates: INTU vs. UPST

Looking into the financial estimates, Zacks projects an 11.90% annual rise in Intuit’s sales and a 14.39% jump in earnings per share for fiscal 2026. Recently, EPS estimates you can find have been trending upwards.

On the other hand, Upstart is eyeing an astronomical 51.36% increase in their sales for 2025. Although EPS figures may have dipped a bit recently, they’re still showing improvement compared to forecasts from two months prior.

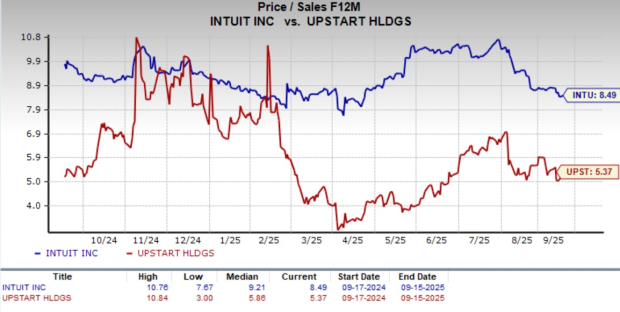

Valuation Analysis: INTU vs. UPST

From a valuation standpoint, it’s vital to note that Intuit shares are currently pricier than those of Upstart. When examining the forward Price/Sales ratio over 12 months, INTU is at 8.49X, while Upstart sits lower at 5.37X. Yet, both are undervalued in comparison to their yearly mediators, at 9.21X for INTU and 5.86X for UPST.

Market Performance Comparisons: INTU vs. UPST

In the past six months, UPST shares have clearly eclipsed both INTU and the broader S&P 500 composite in performance.

INTU or UPST: Which One Should You Buy?

Both Intuit and Upstart are prime examples of how AI is reshaping the fintech landscape. Intuit’s strengths lie in its broad scope and reliable growth trends, making it a standout in financial software. However, if you’re hunting for a bigger upside, Upstart’s aggressive market moves, innovative underwriting technologies, and broad-spectrum growth potential make it highly attractive. While Intuit promises steady gains, Upstart’s rapid advancements position it as the preferred stock to buy at the moment.

Right now, INTU holds a Zacks Rank of #3 (Hold), whereas UPST has a more favorable rank of #2 (Buy). Check out Zacks Investment Research’s full list of #1 Rank (Strong Buy) stocks here!

This content was initially published on Zacks Investment Research (zacks.com).