Main Points

-

While chip stocks shine in the current AI market, they carry some inherent risks.

-

There are alternative stocks that allow investment in AI without major risk exposure.

Artificial intelligence (AI) has emerged as a major winning sector for investors, driving some impressive gains over the recent years. Among these standout performers are chip stocks, especially Nvidia, the leader in AI chips. Given that AI chips are essential for developing and applying AI models, they’re seen as vital for anyone looking to profit from the AI boom.

However, investing in chip stocks isn’t without its pitfalls. In the event of a slowdown in AI development, these companies might face steep revenue declines and falling stock prices.

So, is there a way to invest in AI while minimizing those risks? Let’s explore!

Navigating AI Risks

All tech innovations carry some risks since their future success isn’t certain. Unforeseen external factors—like economic downturns—can also pose challenges. Moreover, investors often fret about soaring valuations for stocks reliant on rapid tech growth.

This shakes up those investors wary of risk. They might reconsider before diving into stocks that heavily rely on breakthrough technologies.

Shifting focus to broader strategies, while chips are pivotal for AI, they’re not the only avenue to engage with this innovation. If you’re looking to keep your risks manageable, consider investing in firms that sell AI technologies but don’t exclusively depend on it for their profits. Enter Amazon(NASDAQ: AMZN).

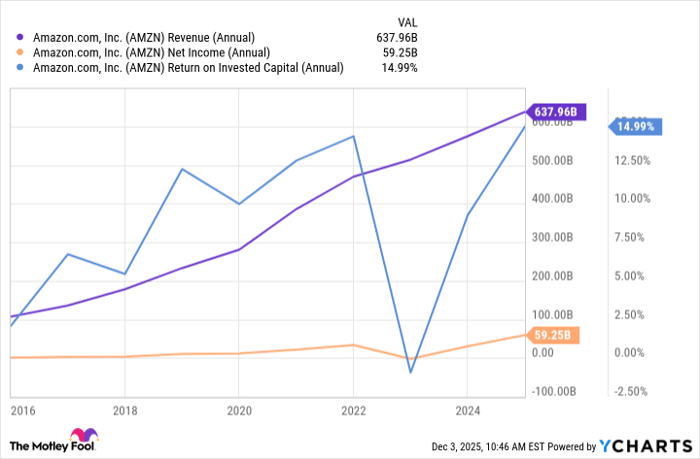

Everyone knows Amazon as a global e-commerce leader, driving sales to a staggering $638 billion in the last year thanks to their fast delivery options and special deals, creating a positive experience for customers. AI plays a nuanced role here, enabling efficiency and enhancing shopping experiences, ultimately driving down costs and benefiting shoppers.

Highlights of AI Products

Yet Amazon truly elevates its game with its cloud computing division, Amazon Web Services (AWS). Through AWS, the company delivers a wide array of AI-related offerings, from essential components like chips to comprehensive AI platforms like Amazon Bedrock. Notably, AWS caters to all budgets, branding its own AI chips at lower price points while also offering higher-end options like those from Nvidia.

Recently, AWS reported rapid revenue growth, hitting an annualized $132 billion revenue run rate—a great insight for investors eyeing potential winners in AI. The optimal part? Amazon doesn’t solely rely on AI spending from customers; its e-commerce division attracts millions of everyday shoppers looking for a variety of essentials.

Proven Business Success

While AI is indeed propelling AWS forward, the cloud service still provides an extensive suite of non-AI offerings, a model that’s proven its worth over time, with steady earnings performance.

Ultimately, even with any obstacles AI growth may encounter, Amazon’s viable business model positions it well in both the e-commerce and cloud sectors.

For those generally wary of valuations in the AI realm, it’s comforting to see that Amazon currently trades at only 32 times predicted earnings, a comparatively reasonable rate at this moment. Overall, Amazon could be your safest bet for investing in AI without directly engaging with chip stocks.

Thinking About That $1,000 Investment in Amazon?

Before you throw your money at Amazon, here’s a thought:

The experts at Motley Fool Stock Advisor recently unearthed their pick for the 10 hottest stocks out there—surprisingly, Amazon didn’t make the list. These stocks hold potential for substantial returns in the coming years.

Take, for instance, if you had invested $1,000 in Netflix when it first appeared on the list on December 17, 2004, you would now be looking at $589,717! Or if you had bought Nvidia when it was suggested on April 15, 2005, you would see your initial investment grow to $1,111,405!

It’s worth noting that the overall average return for Stock Advisor sits at an impressive 1,018%—a notable outperformer even against the S&P 500’s return of 194%. Stay in the loop with their latest top stock selections by subscribing to Stock Advisor.

Find out the 10 top stocks now! >>

Adria Cimino is an investor in Amazon’s stock. The Motley Fool also invests in and suggests Amazon as well as Nvidia.