Important Points to Consider

-

IonQ’s unique approach to quantum computing distinguishes it from other companies.

-

We’re still a few years away from practical quantum computing.

Since the market turned a bit cautious in October, many quantum computing stocks have taken a nosedive, including one that I’m really into: IonQ, listed on NYSE under the ticker (IONQ). At its lowest, it was down about 35% from its highs in October, fueling speculation—could this stock make a big comeback by 2026?

Let’s dive deeper into IonQ and see if it can shine bright in 2026, or if the downturn we’ve seen recently will stick around as we head into the new year.

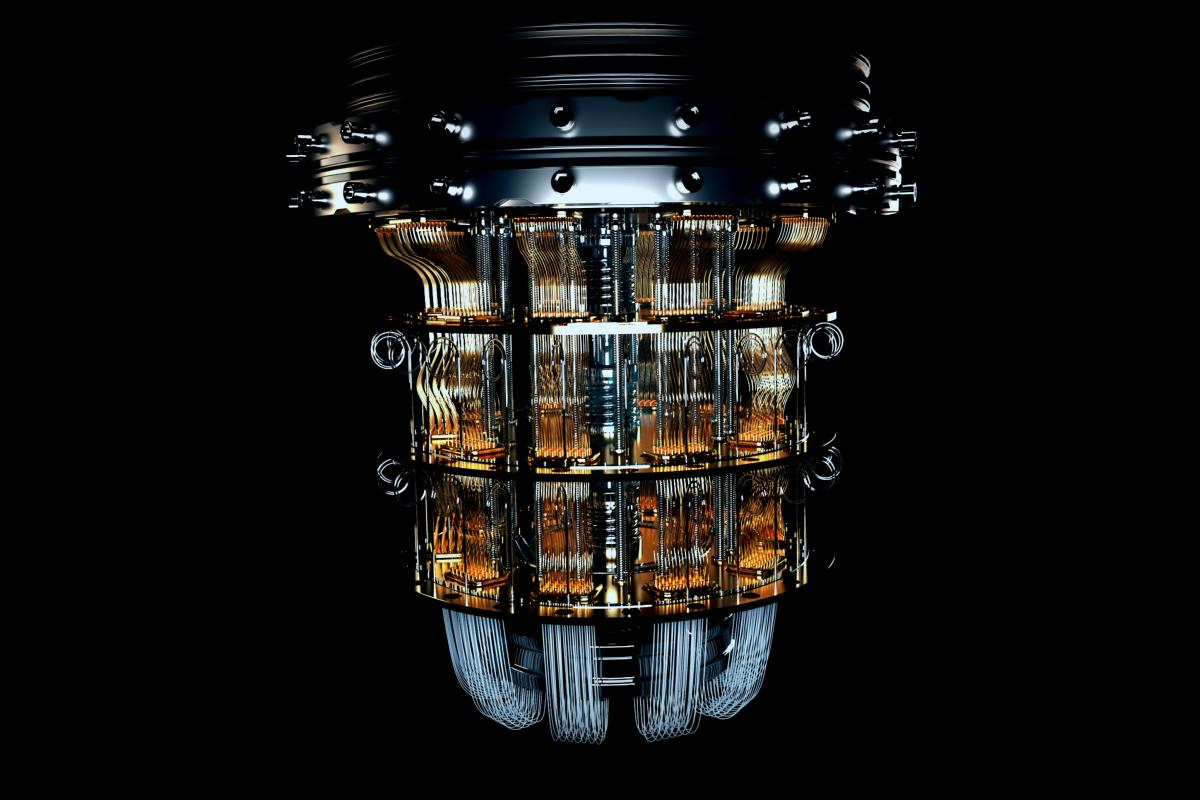

IonQ’s Technology: A Different Game

When it comes to quantum computing, many players rely heavily on a method called superconducting. This involves chilling particles down to almost absolute zero to help control them within a computer.

Though this method is fast and popular, it’s not the most accurate. Companies using this approach have struggled to reach a 99.9% fidelity rate with two-qubit gates, which gauges the success frequency of a quantum computer executing two functions.

In contrast, IonQ has a different take, using a technique called trapped ion. While not exclusive to them, IonQ stands out for being a leader in this specific area. They’ve achieved an impressive 99.99% fidelity, meaning errors occur in merely 1 in 10,000 computations, compared to others who stumble as often as once every 1,000 tries. That’s a big plus; however, there’s a catch—IonQ’s processing times lag behind competitor speeds.

But as it stands, processing speed isn’t the critical issue right now. The holy grail in quantum computing is achieving accuracy. If IonQ can set the pace toward an accepted accuracy benchmark first, they could become a heavyweight in the quantum computing industry, leading to some remarkable stock performance.

Yet, this optimistic scenario isn’t without its uncertainties due to other formidable opponents. The rise and fall of IonQ’s shares will undoubtedly hinge on how they progress towards rolling out a workable commercial quantum computer. But will this vary significantly by 2026?

The Road to Useful Quantum Computing is Long

Let’s be real—a commercially viable quantum computer is still several years away, with 2030 anticipated as the target. That’s quite some time, and unforeseen incidents can surely alter the landscape between now and then. If we rewind back to 2020, for example, the pandemic shifted everything, and few people were even beginning to fathom the impact of artificial intelligence.

Today, we’re in the middle of an AI progression while emerging from the grips of pandemic lockdowns. The twists and turns of events from 2020 to 2025 have been unpredictable, and I can’t say with confidence what will occur leading to 2030.

This uncertainty suggests IonQ’s stock movement could well be tethered to how much risk investors are willing to take in 2026. Should market sentiment turn more conservative then, many quantum computing companies may struggle unless a groundbreaking innovation suddenly speeds up the timeline. I don’t foresee anything like that anywhere near as IonQ continues facing challenges towards becoming a sustainable business.

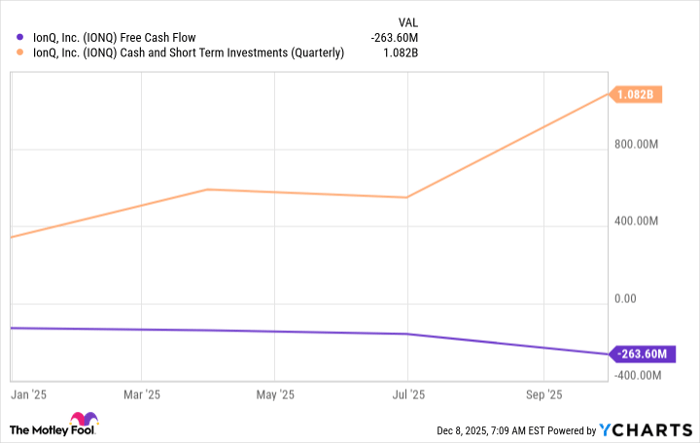

In their latest quarter, IonQ reported revenues close to $40 million but also showed losses exceeding $1 billion. Some of those losses were influenced by changes in the fair value of stock warrants; however, the real issue remains IonQ’s quick loss of cash.

Over the last year, they’ve burnt through more than $260 million according to their free cash flow report and now have around $1 billion in resources left. Essentially, IonQ either needs to figure out a clear business path or secure additional funding soon. Given their current product trajectory, raising more capital might not be a challenge, but it’s a risk that potential investors should weigh carefully.

Predicting whether the company will soar or crash in 2026 boils down to trying to read tea leaves. The real question is how they’ll fare against their rivals in the quantum computing arena. The verdict on this whole industry could take years, so those thinking of investing in IonQ should prepare themselves for a long wait—perhaps around five years—until they’re likely to see returns that genuinely reflect the performance of the business, instead of changing stock market sentiments.

Thinking About Dropping $1,000 into IonQ? Hold Up!

Before you rush to invest in IonQ, there’s something you ought to know:

Analysts over at The Motley Fool Stock Advisor have just identified what they see as 10 top stocks worth snapping up right now… and discovering whether IonQ made it onto that list might surprise you! These selections have the potential for great returns in the next few years.

For context, think about Netflix: it landed this recommendation list on December 17, 2004. Had you dropped $1,000 in at that time, you’d now be looking at a whopping $499,978!* Or take Nvidia, plastered on the same list on April 15, 2005—if you invested then, your $1,000 investment would translate to about $1,126,609!*

It’s worth mentioning that Stock Advisor boasts a total average return of an impressive 971% — that significantly outstrips the S&P 500’s mere 195%. So don’t miss out on checking out their latest top 10 picks when you decide to join Stock Advisor.

See the 10 estrellas приобретения тут >>

*Stock Advisor returns accurate as of December 8, 2025

Keithen Drury holds no stocks mentioned in this article. The Motley Fool is involved with and recommends IonQ, having a disclosure policy also in place.