QUALCOMM Incorporated, known by its ticker QCOM, has a substantial market cap of $173.4 billion and is a major player in the world of wireless technology. Headquartered in San Diego, California, the company operates across three primary segments: Qualcomm CDMA Technologies, Qualcomm Technology Licensing, and Qualcomm Strategic Initiatives.

As a company valued at over $10 billion, QUALCOMM is considered a “large-cap” stock. It’s known for its top-notch Snapdragon chipsets and FastConnect wireless solutions, alongside various cellular and IoT products. A notable trend in their strategy is the integration of on-device generative AI throughout many of its products.

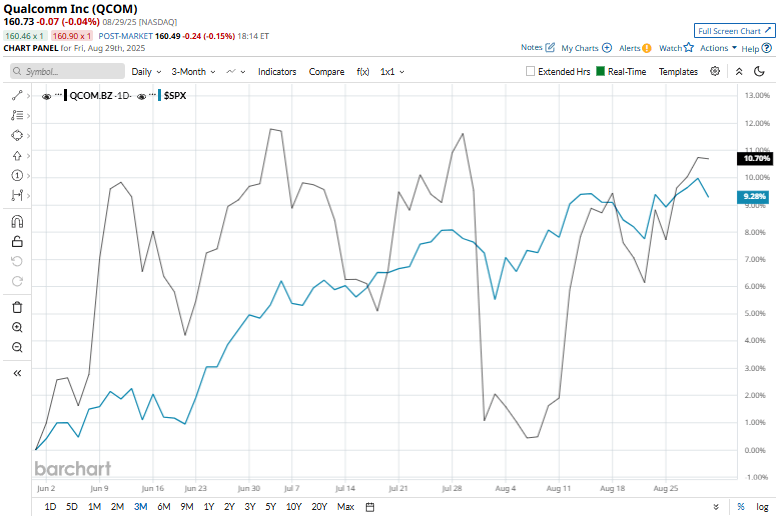

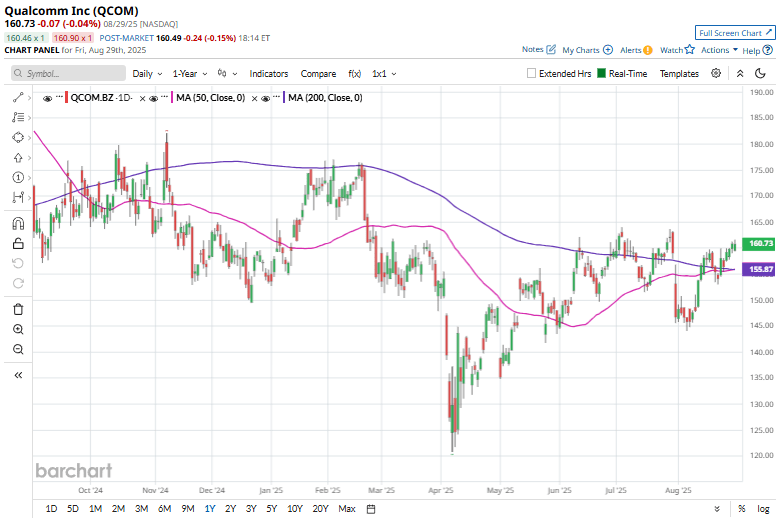

On the stock performance side, QUALCOMM shares have seen a decline of 11.7% since hitting their 52-week high of $182.10 on November 7. Over the last three months, the stock has increased by 8.4%, yet this still falls short of the S&P 500 Index, which has made a 9.3% gain in that same period.

In 2025, QCOM shares have increased by 4.6%, lagging behind the S&P 500’s 9.8% jump. This year, QCOM shares dipped 6.5%, contrasting with the S&P 500’s impressive rise of 15.5%.

However, in terms of recent trading, QCOM stocks have managed to stay above both their 50-day and 200-day moving averages since late August, which might suggest a positive trend.

On July 30, QUALCOMM announced its Q3 earnings results, which were a mixed bag. Unfortunately, this led to a 7.7% decline in their stock during that trading day. Despite showing a year-over-year revenue growth of 10.3% to reach $10.4 billion, the numbers fell slightly short of analysts’ expectations—particularly in their handset and automotive revenue sectors.

For contrast, NVIDIA Corporation (NVDA) continues to outshine QCOM, boasting impressive gains of 38.7% in the past 52 weeks and 29.7% on a year-to-date basis.

As for analyst sentiment, QCOM holds a consensus rating of “Moderate Buy” from the 32 analysts watching it, with a mean price target of $179.88, suggesting an 11.9% upside from current prices.

As of the publication date, author Kritika Sarmah has no positions in any examined stocks, and this piece serves purely informational purposes. For more extensive details, you can check the Barchart Disclosure Policy here.