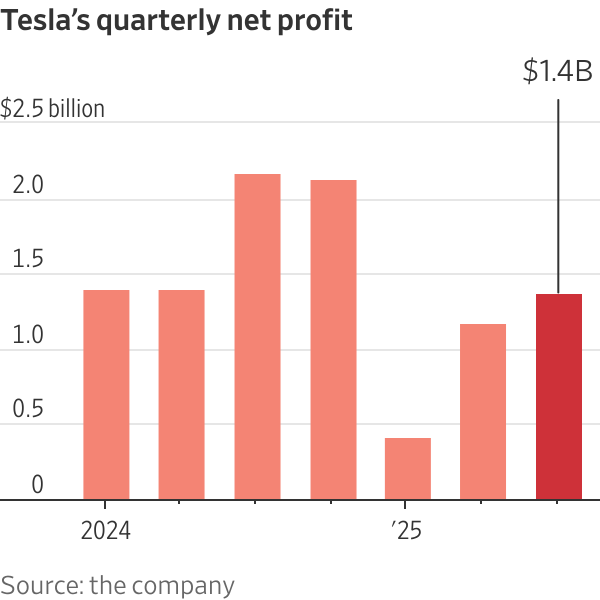

In a twist, Tesla has reported a substantial 37% fall in net income during Q3, marking a not-so-great turn for a company otherwise basking in record sales. Just before a crucial November vote for a potentially lucrative new pay plan for CEO Elon Musk, viewed at over $1 trillion, these numbers might raise some eyebrows.

During the investors’ call on Wednesday, Musk put the spotlight on the significance of this pay plan, which would grant him an extra 12% control over the company over the next decade. He expressed his concerns about his authority at Tesla as they venture into exciting territory like artificial intelligence and robotics, referencing their humanoid robot, Optimus. “If I build this huge robot army, can I just be removed in the future?” he pondered. “I don’t think it’s wise to build that army without having some degree of control over it.”

Musk took a moment to brag about the advancements in Tesla’s full self-driving software, with aspirations to eliminate safety drivers from the robotaxis in Austin by year-end. By the second quarter of next year, the company plans to kick off production of their futuristic Cybercab, a self-driving two-seater without a steering wheel or pedals.

He described it as a car that would respond like a live being as the AI capacity improves. “I wonder what level of intelligence a car should have; it might end up getting bored, you know?”

Despite a record-breaking revenue of $28 billion in Q3—up 12% year-over-year from its booming electric vehicle business—discussion on that front was minimal during the call. The free cash flow for the quarter reached an impressive $4 billion, very much bolstered by the rush of buyers capitalizing on the $7,500 federal tax incentive before its cut-off on September 30.

On the earnings front, even as sales surged and Tesla capitalized on the tax incentives, net income dropped to $1.4 billion from $2.2 billion last year. The company pointed to increased R&D spending in AI as a significant contributor to this decline, along with a steep 44% dip in revenue from carbon credits, now sitting at $417 million.

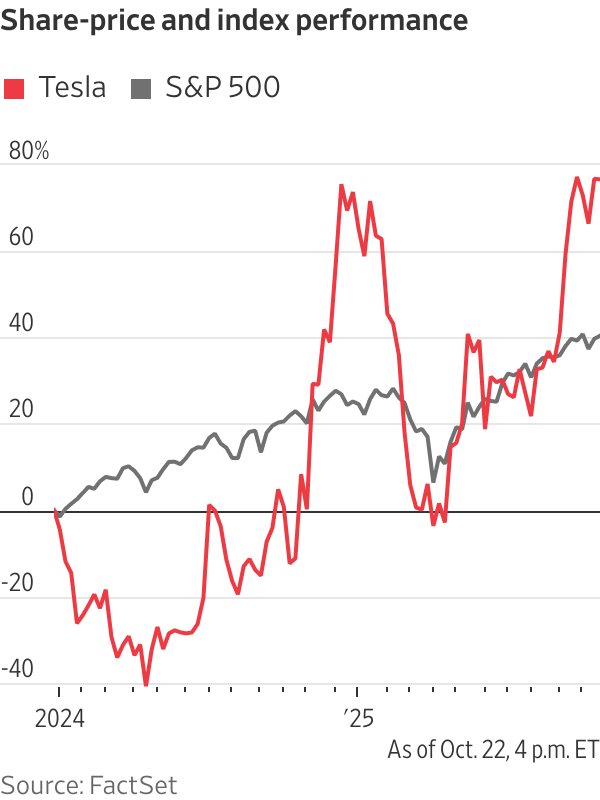

After hours, Tesla’s share price slumped over 3%, which leads one to think about the future sales trend. Musk’s keen focus on ramping up AI initiatives suggests that maintaining sales momentum could be challenging, especially in a saturated EV market, all while chatting about older vehicle designs and receviving fewer subsidies for buyers.

Musk had previously stated that they might undergo “a few rough quarters” ahead of these developments.

As discussed on the investor’s call Wednesday, Musk emphasized that Tesla stands at a pivotal moment concerning AI. He felt many people underestimated how much of a step forward autonomous vehicles would represent.

“Honestly, it will be like a shockwave,” he stated.

Investors are set to weigh in on Musk’s hefty compensation plan on November 6 during the company’s annual meeting. The board has often argued that such a lucrative package is crucial to keep Musk invigorated, particularly as Tesla seems keen to transition beyond electric vehicles.

Owning around 15% of Tesla, Musk has remarked in the past that a lack of 25% voting rights could lead him to pursue AI ventures independently. He took to X this past Sunday to vent about possibly leaving Tesla if the pay package didn’t gain enough support.

“Tesla is more valuable than all other automotive companies combined. So which of those other CEOs would you want running Tesla? Just not me,” was his pointed reply to a concerned shareholder.

Whether Tesla can continue to grow its car division without U.S. tax credits remains a big question now that the incentives expired last month, thanks to President Trump’s budget plans.

Musk’s political leanings over the past year have reportedly hurt Tesla’s public image, particularly in states like California and parts of Europe where the brand once enjoyed robust popularity. Sales saw more than a 13% drop in the first half of this year, with net income cratering 71% in Q1 and further declining by 16% in Q2.

In the race against brand competitors, within the U.S. and abroad in China, Tesla is also facing challenges in retaining its market share.

Some investors have grown restless with Tesla’s aging lineup. The company recently unleashed stripped-down versions of its sought-after Model Y SUV and Model 3 sedan, leading to disappointment. Though these models are cheaper by $5,000 than their previous iterations, they still carry higher prices compared to their feature-rich predecessors sold with federal incentives.

In an announcement on Wednesday, the National Highway Traffic Safety Administration revealed a safety recall involving about 13,000 vehicles due to battery malfunctions potentially leading to stalls, specifically targeting Tesla’s 2025 Model 3 and 2026 Model Y.

This summer also saw the rollout of Tesla’s Robotaxi service in cities like Austin, Texas, currently using a safety driver. Their service is also tested in the San Francisco Bay Area but remains limited due to a waiting list.

Musk mentioned Tesla’s deliberate approach towards scaling this service, stating, “Even one accident will dominate the headlines globally.”

Contact: Becky Peterson at becky.peterson@wsj.com