Highlights

-

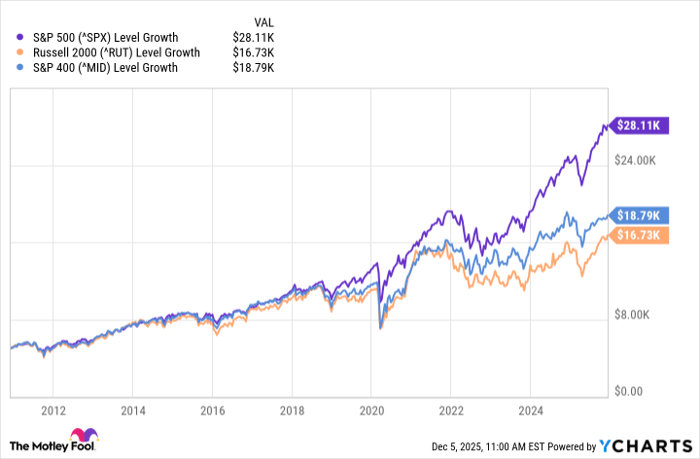

The S&P 500 index has recorded impressive gains in the last 15 years, particularly shining bright in the past three years.

-

The combination of low interest rates and the Federal Reserve pumping money into the economy has fueled this growth.

-

Recently, there’s been a growing excitement about artificial intelligence, with many stocks expected to gain from it.

Despite some ups and downs throughout 2025, the stock market is strong. As of December 5, it has jumped 16.8% this year alone. This solid performance puts the S&P 500 index on track for three consecutive years with returns over 20% — an achievement we rarely see in a century.

Low interest rates, ongoing economic health without recession, and the rise of artificial intelligence are contributing to a lengthy bull market, which many on Wall Street believe will carry on.

But it’s not all sunshine. The current economic climate isn’t perfect: living expenses are pretty high and many people find it hard to afford housing. This makes saving up for retirement tricky. Regardless, interest rates have been quite low since the last recession, with the Federal Reserve injecting vast amounts of cash into the economy, likely bumping up asset prices.

Let’s see how much that $5,000 investment in the S&P 500 from 15 years ago would be worth today.

The Market is Booming

With soaring asset values and high living costs, the stock market has produced substantial returns. This has boosted retirement savings and disposable income for investors, even if the actual growth feels less impressive after accounting for real inflation.

As depicted in the chart, an investment of $5,000 in the S&P 500 15 years ago would now be worth over $28,000. This performance surpasses what you’d expect from the Russell 2000 and S&P 400 that include mid-cap stocks. That mentioned sum reflects a compound annual growth rate exceeding 12% for these 15 years.

Thinking About Investing $1,000 in the S&P 500 Index?

Before you take the plunge into the S&P 500 Index, consider this:

The analysis team at Motley Fool Stock Advisor has pinpointed their top 10 stocks for investors right now—and the S&P 500 Index didn’t make the list. These stocks could bring substantial returns in the years ahead.

For instance, when Netflix first got on this list back in December 2004, if you’d invested $1,000 then, you’d have around $540,587! And Nvidia made it to the list in April 2005, turning a $1,000 investment into about $1,118,210!

To top it off, the overall average return from Stock Advisor is an impressive 991%, significantly outpacing the S&P 500’s 195%. Don’t miss your chance to check out their latest top 10 stock picks when you join Stock Advisor.

See the 10 stocks

*Stock Advisor returns are calculated as of December 8, 2025.

Bram Berkowitz does not hold any stocks mentioned. The Motley Fool has no positions in any of the stocks stated. For more, see their disclosure policy.