Key Takeaways

-

Palantir is a major player when it comes to AI software for both the government and businesses.

-

The company saw an impressive revenue growth of nearly 50% last quarter.

-

However, the stock is considered very pricey at the moment.

Palantir(NASDAQ: PLTR) has emerged as one of the hottest stocks in artificial intelligence this year, experiencing an extraordinary 144% increase in value. The positive financial news seems never-ending, with each quarter bringing results that surpass expectations.

While Palantir has some strong advantages, a question new investors might have is whether this momentum can continue into the next three years. Let’s dive in and find out.

Looking to invest your $1,000 wisely? Check out what our analysts recommend as the 10 best stocks to buy now.Learn more >

Palantir is Making Waves Across Various Industries

Initially designed for government applications, Palantir’s AI platform has also made significant inroads into the commercial space. Its government segment continues to provide a substantial portion of revenue, but its growth among U.S. companies has also been solid.

The tools Palantir provides help businesses process massive amounts of data using AI and generate actionable insights for smart decision-making. Through the company’s artificial intelligence platform (AIP), users can even automate tasks with AI assistance, making processes more efficient.

Thanks to this powerful offer, Palantir enjoys strong financial performance, with commercial revenue up 47% year over year to $451 million, alongside a 49% year-over-year increase to $553 million for government contracts. This gives an overall growth of 48% in just the second quarter, and there’s no sign of a slowdown in the outlook.

If Palantir can maintain this growth, it could lead to a similar rise in stock price. However, that’s contingent on whether the stock price becomes more justifiable, which is a question mark given its apparent overvaluation.

Is Palantir’s Stock Overvalued?

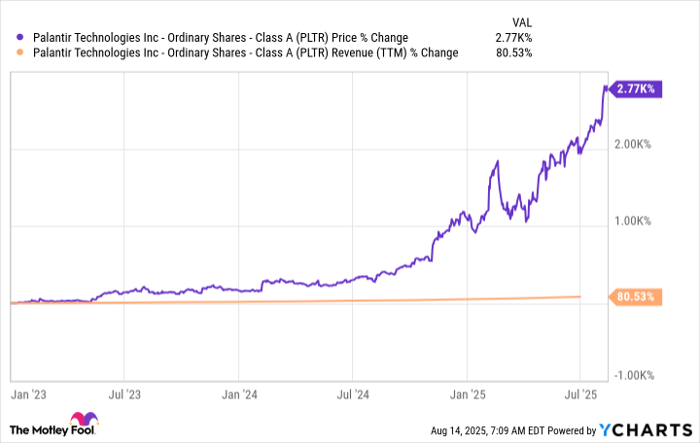

Since the beginning of 2023, Palantir’s revenue has soared roughly 80%, while stock value has surged more than 2,700%. This disconnect raises eyebrows regarding Palantir’s soaring valuation.

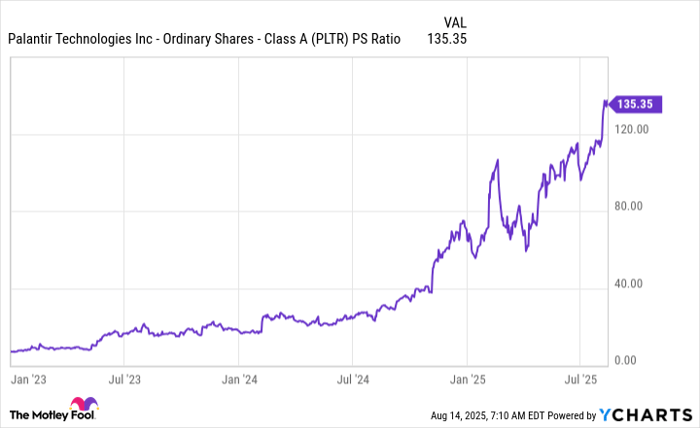

With a staggering price-to-sales ratio of 135, Palantir is undeniably among the highest-priced stocks available.

This leads to the realization that much growth potential is likely factored into the stock’s current pricing. But what’s the actual price forecast for Palantir in three years?

Suppose Palantir could accelerate its growth rate to 50% and sustain that momentum over the next three years. If the company reaches a profit margin of 35%—which is quite impressive for a software entity—it would yield around $11.6 billion in revenue and $4.1 billion in profit. These figures mark a significant leap from today’s $3.4 billion in revenue and $773 million in profit. However, at existing valuations, the stock could still come across as pricey.

If we evaluate using a high earnings multiple of 50, Palantir could have a market cap hitting $205 billion. This suggests that, based on the current number of shares, a price around $86.30 per share would follow—nearly half its present valuation. That’s a steep decline, indicating that investors should be aware of the gratifications already priced into Palantir’s stock now.

While Palantir is undoubtedly performing well, the price at which shares currently trade may exclude future growth opportunities. Investors might consider seeking alternatives in the AI space that might offer significant gains without the encapsulated expectations currently surrounding Palantir.

Should You Buy Palantir Technologies Stock Now?

Before making any moves on Palantir Technologies, there are nuances to weigh:

The Motley Fool Stock Advisor has called out what they believe are the 10 best stocks to buy right now—and remarkably, Palantir Technologies hasn’t made this particular lineup. Those ten companies are poised to provide strong returns in the upcoming years.

For some perspective, think about how Netflix was picked on December 17, 2004… an investment of $1,000 would now be worth approximately $668,155! Or consider Nvidia‘s listing back on April 15, 2005… your $1,000 from that recommendation would have skyrocketed to $1,106,071!

It’s intriguing to note that Stock Advisor boasts an average return of 1,070%, evolving dramatically compared to the S&P 500’s 184%. Join Stock Advisor to unlock insights into the latest prime stock list.

Explore the 10 stocks recommended >

* Stock Advisor returns as of August 13, 2025

Keithen Drury is not a shareholder in any of the mentioned stocks. The Motley Fool does, however, recommend Palantir Technologies. For more details, review the disclosure policy.