Google’s revenue from its Services segment is soaring thanks to increasing ad sales in Search and YouTube. Their new features — powered by artificial intelligence — are pushing the envelope on what’s possible in online services, reaching over 2 billion users each month across 200 countries and in 40 languages. Projects like auto-dubbing on YouTube are helping both creators and brands reach even more fans.

Alphabet’s game plan includes rolling out AI features consistently, and it’s clearly paying off. A recent introduction is their new photo editing model from Google DeepMind, featured in the Gemini app. Alongside, they keep enhancing Gemini Live by adding support for more languages and countries, allowing it to guide users directly on their screens. On top of that, Gemini now connects essential apps like Google Calendar, Google Tasks, and Google Keep

Gemini’s technology isn’t just flashy; it also offers real-time translation, supporting over 70 languages like Arabic, French, and Spanish. This is a massive leap for live conversations and makes a world of difference for global users.

Thanks to these innovations, Google Services revenue climbed by 11.7% year over year, reaching a staggering $82.54 billion, which upon examination accounted for a hefty 85.6% of their total earnings for the second quarter. Analysts are optimistic, projecting revenues to touch $84.51 billion in Q3 2025, indicating a solid 10.5% increase compared to last year’s figures.

GOOGL is in a Tough Spot

On the battleground of AI services, GOOGL faces strong competitors like Apple and Microsoft. Apple has made significant strides with its Apple Intelligence, which is integrated into their entire lineup from iPhones to Macs. The latest updates have rolled out in multiple languages, including French, German, and Spanish, expanding rapidly around the globe.

Meanwhile, Microsoft is doubling down on its search engine Bing with some impressive AI integrations, proud of their partnership with OpenAI. They introduced significant features like Copilot Search and Bing Video Creator recently. Their cloud services are becoming staples for businesses wanting to adopt Generative AI capabilities.

Examining the Stock Performance of GOOGL

When we take a look at Alphabet’s stock, we see a 12.4% increase since the start of the year, but it lags just behind the overall growth of the tech sector at 12.9%.

Stock Valuation Insights

GOOGL is currently trading with a price-to-sales ratio of 7.12, above the industry average of 6.66. Meanwhile, its value score lags, sitting at F.

Earnings Predictions

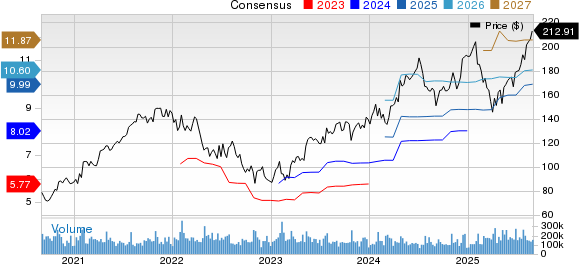

The projections for 2025 earnings estimate stands at $10 per share, which is a 2.8% boost over the last month, representing an encouraging 24.4% growth compared to fiscal 2024.

Currently, Alphabet boasts a Zacks Rank of #3 (Hold), which indicates a stable position in the market. For even more transparency, you can find out about the top stocks holding a Zacks #1 Rank (Strong Buy) status.

The information in this article first appeared on Zacks Investment Research (zacks.com).